Forex trading, also known as foreign exchange trading, is the process of buying and selling currencies in the global marketplace. It is one of the largest and most liquid financial markets in the world, with an average daily trading volume exceeding $6 trillion. Traders engage in the Forex market for various reasons including profit, hedging, and speculation. The intricacies of this market can be daunting for newcomers, but understanding the fundamentals is crucial for success. To learn more about Forex trading concepts and methods, visit what is trading forex fx-trading-uz.com.

At its core, Forex trading involves the exchange of one currency for another at an agreed price. Currencies are traded in pairs, with the first currency known as the base currency and the second as the quote currency. For example, in the currency pair EUR/USD, the Euro is the base currency and the US dollar is the quote currency. The price of this pair indicates how much of the quote currency is needed to purchase one unit of the base currency.

The Forex market consists of various currency pairs, but they can generally be categorized into three main groups: major pairs, minor pairs, and exotic pairs.

Forex trading is conducted over the counter (OTC), meaning that transactions occur directly between parties, typically through electronic trading platforms. A Forex broker acts as an intermediary, providing access to the market and facilitating trades for individual and institutional investors.

When a trader speculates on currency movements, they can go long (buy) if they believe the base currency will strengthen against the quote currency, or go short (sell) if they predict the opposite. The objective is to close the trade at a profitable rate, capitalizing on the price movement.

Leverage is a significant feature of Forex trading, allowing traders to control larger positions with a relatively small amount of capital. For example, a leverage ratio of 100:1 enables a trader to control $100,000 with just $1,000 in their trading account. While leverage can magnify gains, it also increases the potential risk, making it crucial for traders to employ risk management strategies.

Successful Forex trading often depends on the analysis of market conditions. Two primary methods of analysis are technical analysis and fundamental analysis.

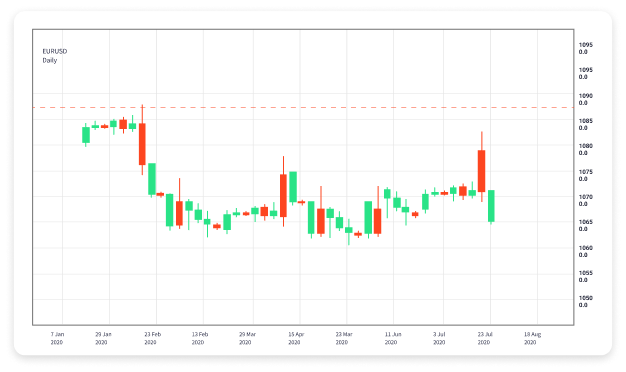

Technical analysis involves the study of past price movements and market trends using charts and indicators. Traders analyze price patterns, moving averages, and various technical indicators to forecast future price movements and make informed trading decisions.

Fundamental analysis, on the other hand, focuses on the economic, social, and political factors that influence currency value. This includes interpreting economic indicators such as interest rates, employment numbers, inflation rates, and geopolitical events. Traders who utilize fundamental analysis often keep an eye on economic news releases and financial reports to inform their trading strategies.

There are several Forex trading strategies that traders employ, depending on their risk tolerance, trading style, and market conditions. Some of the most common strategies include:

Effective risk management is crucial for long-term success in Forex trading. Traders must be aware of the risks associated with trading and implement strategies to mitigate potential losses. Key risk management techniques include:

The psychological aspect of trading is just as essential as the technical and fundamental analysis. Traders often face emotional challenges such as fear and greed, which can lead to irrational decision-making. Developing a disciplined trading mindset and adhering to a well-defined trading plan can help traders manage their emotions and improve their performance.

Forex trading offers a dynamic and potentially lucrative opportunity for traders worldwide. While the potential for profit exists, it comes with inherent risks that require thorough research, strategy, and risk management. Understanding the basics of Forex trading, including currency pairs, analytical methods, trading strategies, and risk management techniques, is vital for anyone looking to navigate this complex market successfully. Whether you’re a beginner or an experienced trader, continual learning and adaptation are key to thriving in the Forex trading landscape.