The importance of transparency in initial currency offers (ico)

As the cryptocurrency world continues to grow and mature, it has become more important for the issuers to give priority to transparency during the initial currency (ICO). While cryptocurrencies have gained significant attention in recent years, many investors remain skeptical about their potential to make long -term profits. However, a blocking of transparency can lead to a number of problems that can affect not only the company behind cryptocurrency, but also investors and users.

** What is an original currency offer (ico)?

An initial offer of currencies is a way for companies or natural persons to raise funds by issuing new digital coins or tokens to the public. These chips, or icons, are often created with a specific purpose in mind, such as developing a new product or service, increasing capital or financing of research and development.

The risks of lack of transparency

Lack of transparency can lead to multiple risks for both issuers and investors, including:

* Regulatory risks : Companies that do not disclose their activities or operations can be subject to regulatory control from government agencies. This can lead to fines, penalties or even the company closes.

* Market handling : Without clear information about ICO financial, supply chain or other key details, investors can become vulnerable to market handling. This can lead to volatility of prices and potential losses for investors who do not respect.

* Security risks : If an ico is not transparent enough, it can be vulnerable to security threats, such as hacking or theft. This can lead to significant financial losses for investors.

** What does transparency mean in the context of an ico?

Transparency, refers to the provision of clear and accurate information about the activity, operations, finances and other key details of an ICO company. This includes:

* Financial disclosure : Clearly disclosure the income, expenses and profit of a company.

* Supply chain information

: Providing detailed information about the Cryptocurrency or token supply chain, including suppliers, producers and distributors.

* Technical details : Disclosure of technical details about the technology underlying cryptocurrency or token, including development benchmarks, test protocols and security measures.

* Risk disclosure : clearly disclosing potential risks associated with ICO, such as market risk, regulatory risk and operational risk.

best practices for ico

To ensure transparency during an ico, companies can follow the best practices such as:

* Financial information disclosure : Regularly disclosing financial information, including income, expenses and profit or loss.

* Providing the transparency of the supply chain

: It clearly reveals the details of the supply chain, including suppliers, producers and distributors.

* Risk research : Research the potential risks associated with ICO, such as market risk, regulatory risk and operational risk.

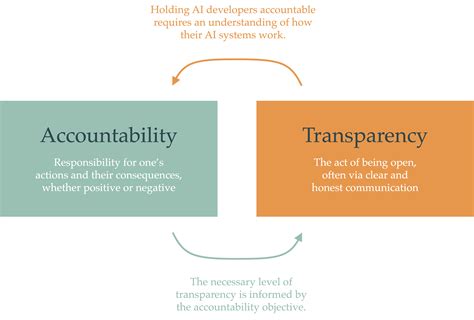

* Maintaining a powerful governance structure : Establishing a powerful government structure to ensure transparency and responsibility.

Conclusion

The importance of transparency in the initial currency offers can be overvalued. By priority of transparency, companies can be able to trust investors and users, to mitigate the risks and to create a long -term value for interested parties. As the cryptocurrency market continues to grow and evolve, it is essential for issuers to give priority to transparency throughout the ICO.

Recommendations

For companies that consider an ico:

* Perform thorough research : Perform thorough research on your target audience, industry trends and regulatory requirements.

* Establish a strong governance structure : Establishing a powerful governance structure to ensure transparency and responsibility.