“Cryptocurrency Correlations and the Role of Cryptocurrencies in Closely Related Markets”

The cryptocurrency market has experienced rapid growth in recent years, with many assets experiencing significant price fluctuations. However, despite this volatility, there is growing interest in studying correlations between different cryptocurrencies and traditional financial markets. In this article, we will delve into the world of cryptocurrency market correlations and explore how they affect the performance of different cryptocurrencies.

What are cryptocurrency market correlations?

Crypto market correlations refer to the relationships or connections between the prices of different cryptocurrencies. These correlations can take many forms, including positive, negative, or neutral relationships. For example, the correlation between Bitcoin (BTC) and Ethereum (ETH) can indicate that investors tend to favor one asset over the other.

Hedging Services: A Key Player in Cryptocurrency Market Correlations

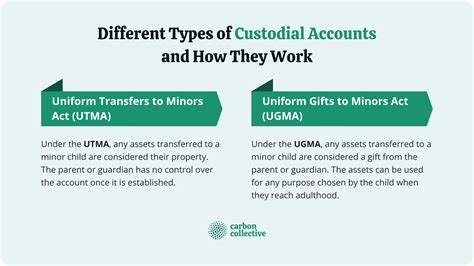

Hedging services play a crucial role in cryptocurrency market correlations. Custodians are third-party entities responsible for managing and storing cryptocurrencies on behalf of their clients or organizations. The most prominent custodian in the industry is Coinbase, which has grown to become one of the largest cryptocurrency exchanges.

The relationships between different currencies through custody services can be quite interesting. For example, a Chainalysis study found that Bitcoin (BTC) correlated more with other cryptocurrencies such as Ethereum (ETH), Litecoin (LTC), and Ripple (XRP) than with traditional fiat currencies such as USD or EUR. This means that investors tend to prefer these alternative cryptocurrencies over traditional assets.

Candlestick Chart Analysis: A Visual Representation of Cryptocurrency Market Correlations

Candlestick chart analysis is a popular method for visualizing market trends and correlations between different cryptocurrencies. The most widely used candlestick charts are Bollinger Bands, which display price action using a number of moving averages to identify trends and volatility.

When analyzing candlestick charts, it becomes clear that some patterns can indicate correlations between different cryptocurrencies. For example, a green-shaded area on a chart that indicates a strong uptrend for a particular cryptocurrency can also indicate a correlation with other assets, such as Bitcoin (BTC) or Ethereum (ETH).

Cryptocurrencies and Financial Markets: A Complex Relationship

While cryptocurrency market correlations are fascinating, they also raise interesting questions about their relationship with traditional financial markets. In this section, we will explore how cryptocurrencies interact with financial markets such as stocks, commodities, and interest rates.

Some notable examples of cryptocurrencies influencing traditional financial markets include:

: As the largest altcoin by market capitalization, Ethereum often influences traditional stock markets. Its correlation with stocks could indicate investor sentiment regarding the potential for Ethereum token supply to drive demand for other cryptocurrencies.

Conclusion

In conclusion, cryptocurrency market correlations are an exciting area of study that can provide valuable insight into the performance and behavior of various cryptocurrencies. By analyzing candlestick charts and understanding custody services, investors can gain a better understanding of how these assets interact with traditional financial markets.