Cryptocurrency KYC Regulations: What Crypto Users Should Know

The rise of cryptocurrency has brought about a new era of digital currency trading, with users able to buy, sell, and store value without the need for traditional financial institutions. However, with this increased accessibility comes a set of regulations that require crypto users to verify their identities and comply with Know Your Customer (KYC) laws. In this article, we’ll delve into the world of KYC regulations and what crypto users should know about these complex rules.

What is KYC?

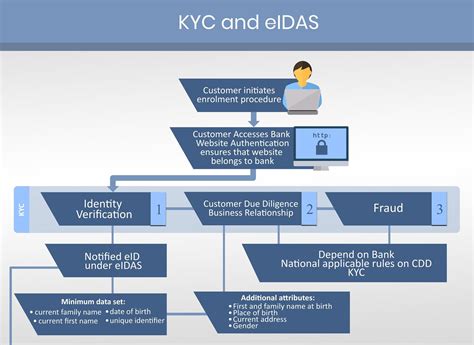

Know Your Customer is a term used in finance to refer to the process of verifying an individual’s or business’s identity to prevent money laundering, terrorist financing, and other illicit activities. It involves confirming the user’s identity through various means, such as providing identification documents, proof of address, and other personal details.

KYC Regulations for Cryptocurrency Users

The regulations surrounding KYC for cryptocurrency users are similar to those found in traditional financial institutions. Here are some key aspects that crypto users should be aware of:

: Crypto exchanges and wallets may require users to provide identification documents, such as a passport, driver’s license, or national ID card, to verify their identity.

KYC Process for Different Types of Cryptocurrencies

: The process for altcoins is similar to that of BTC, with users providing identification documents and proof of address.

Consequences of Non-Compliance

Failure to comply with KYC regulations can result in serious consequences, including:

Best Practices for Crypto Users

To avoid non-compliance with KYC regulations, crypto users should:

Conclusion

KYC regulations are an essential aspect of cryptocurrency trading, and crypto users must comply with these rules to avoid fines, penalties, and reputational damage.