The Widspread Influence of Fears (FOMO) on Cryptocurrency Trade

In recent years, the cryptocurrency World has experienced tremendous growth and popularity. Decentralized Finance (Defi), Initial Coin Supply (ICO) and Increasing Access to Digital Purses Allowed People to Become More Easier to Engage In The Market. However, there is a more threatening power behind this excitement: The Fear of Disappearing (FOMO).

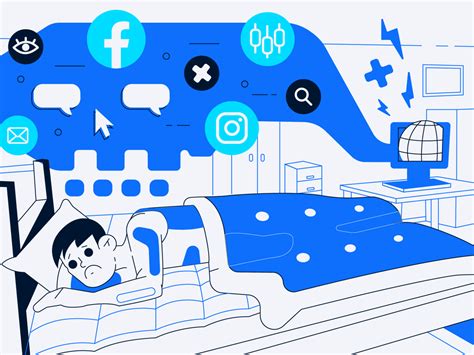

Fomo is a psychological phenomenon that describes anxiety and pressure people feel when they are unable to participate in a certain trend or event. In the context of cryptocurrency trading, fomo can be particularly harmful, forcing investors to make impulsive decisions based on Fear Rather Than Carful Analysis.

fomo psychology

Studies have shown that fomo is closely linked to cognitive bias, such as:

1

Confirmation Breeds : Investors tend to look for information that confirms their previously views and ignores contradictory evidence.

3

Non -Mare : Fear of the release of possibly benefits is more harmful than fear of loss.

how fomo effects cryptocurrency Trade

In the Cryptocurrency Market, fomo can manifest in Several ways:

1

Herd Behavior : Since a large number of investors buy or sell cryptocurrencies at the same time, prices tend to move in tandem with the most active.

3

Price impulse : fomo can guide price movements based on emotional reactions to price fluctuations Rather than rational analysis.

fomo -LED Transaction Examples

1

Binance Price Drop (2019) : Sudden Decline in Binance Coin (BNB) on the market Sent Shock Waves in the Market, Forcing Many Investors to Sell Their Participation Massively. As a result, a sharp drop in prices was reduced and significant losses for those who had taken measures to provide their assets.

FOMO Reduction in Cryptocurrency Trade

While fomo can be a powerful force in cryptocurrency trade, it is not insurmountable. Here are some strategies that will help you navigate the market and make more informed decisions:

1

Diversify : Spread Investment in Several cryptocurrencies to reduce exposure to any particular asset.

3

Create Clear Goals and Risk Management Strategies

: Create Special Investment Goals and Set Realistic Risk Parameters to Help You Make More Informed Decision.

4

Stay Informed, But Avoid Emotional Decision -Making : Be aware of market news and analysis, but avoid attaching to fear -based emotions.

Conclusion

Fear of Disappearance (FOMO) is a comprehensive force in Cryptocurrency Trade, which can have significant consequences for investors who are not read to navigate this high -rate environment. Understanding Fomo’s psychology and takeing steps to reduce its consequences, you can make more informed decisions and achieve your investment goals. Remember that when engaging in the world of cryptocurrencies, it is always a key role, but it is also important to be vigilant against the acceptance of fear temptation.