Understand the difference between BEP2 and Bep20 in Binance Smart Chain

With respect to cryptocurrencies, one of the most exciting aspects is the wide range of tokens available for purchase and negotiation in several block chains. Two popular options that have caught significant attention in recent years are Binance Smart Chain (BSC) and its native token, Binance Coin (BNB). In this article, we will immerse ourselves in the world of Bep2 against BeP20, specifically focusing on its differences in the Binance of Smart Canals.

What is a Token?

Before immersing yourself in the specificities of Bep2 and Bep20, let’s define what a file is. A Token is a digital asset that represents an asset or specific service in a blockchain network. Think of tokens such as cryptocurrencies themselves, but with unique characteristics that distinguish them from traditional fiduciary currencies.

Bep2 vs Bep20: a brief description

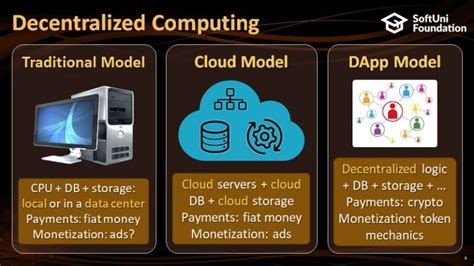

Bep2 and Bep20 are native tokens created in Binance Smart Chain (BSC), which is one of the greatest decentralized exchanges (DEX) in the world. The main difference between these two tokens is found in their structure, their usefulness and use.

Tokens Bep2

Bep2 tokens are created using the Bep-2 protocol, which was first introduced by Binance Labs in 2018. This protocol allows the creation of tokens with a specific set of attributes, such as:

* Fixed energy source

: A limited number of tokens can be achieved in the launch.

* Tokens economy unlocked : Tokens can be unlock after a certain period to encourage users to keep them.

* Smart Contracted : Tokens are stored in the block chain and run through smart contracts.

Bep2 tokens generally offer more control over their diet, blocking and utility mechanism compared to BEP20. Some examples of BSC native tokens with BeP2 characteristics include:

* BINANCE COIN (BNB) : A GOVERNMENT SHEET that can be used to vote on proposals.

* TOKEN FINANCE OF SAMBA (SBM) : A loan protocol that rewards users with interest payments.

Tokens Bep20

Bep20 tokens, on the other hand, are created using the Bep-20 protocol, which was first introduced by OpenSea in 2018. This protocol allows the creation of tokens with a set of more flexible attributes:

* Without fixed power supply : There is no limit for the number of tokens that can be hit.

* Based on liquidity : Tokens are distributed in several exchanges and wallets, which makes them easily negotiable.

* Tokens standardization : Tokens Bep20 follow the standard standard of Token ERC-20, ensuring compatibility with other platforms.

Bep20 tokens often offer more flexibility in terms of use compared to Bep2 tokens. Some BSC native tokens examples with BeP20 characteristics include:

* Token sushiiswap (SRW) : A decentralized exchange that rewards users with interest payments.

* Finance Token Dharma (DFN) : A loan protocol that rewards users with interest payments.

Key differences

Now that we have covered the bases of Bep2 and BEP20, let’s underline some key differences between these two tokens:

| | Tokens bep2 | Tokens bep20 |

| — | — | — |

|

Food | Fixed power supply | No fixed power supply |

|

Liquidity | Greater liquidity due to several exchanges | Weaker liquidity due to a single exchange distribution |

|

Use | More control over the economy and the usefulness of tokens | More flexibility in terms of use |

|

Standardization | Standard Token ERC-20 standards | Non-standardized tokens (Bep-2 protocol) |

In conclusion, BEP2 vs Bep20 are two different types of tokens created in the Binance of Smart Canal. Although both have their advantages, it is essential to understand the differences in supply, liquidity, use and standardization between these two tokens.

Conclusion

The world of cryptocurrency is constantly evolving, and understanding the nuances between BeP2 and Bep20 can help you make informed decisions during investment or negotiation on BSC.