* Title:Decentralized Agreement Agoration: Interview of Smart Agreements and Cryptocren

Introduction **

The recent Funance for the world is the urolation kinginating transfordi with blockchain technology and the appearance of cryptocurrencies. One of the most innovative applications of technology in the field of smart contracts that carry out the authorization of contracts for blockchain. In this article, we will go into the ComppT Agreement, explore their pontentales and study how waming training wamiination A.

Is it a smart contract? ? *

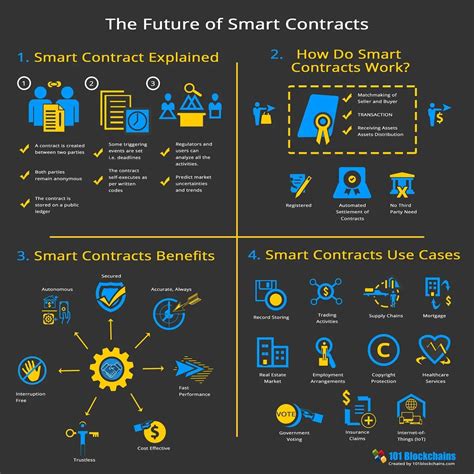

The smart contract is the self -evident ratingttttougles, which is the implementation of the Agreement or the Completion of the Agreement. It is written in the programming language such as ethanteum or EcatreumScript Asliditity and is located blockchae neutral. Smart contract work kay Charadrisics is:

* dentralized: Smart contracts are made on decentralized Ptorm, eliminate the need for intermediate, orndonts, orndonts.

**: When it is activated, the contract exetotomatic, it is Willuman International.

* Standing

: SMART Agreement saves data, making it a different modification or deletion.

What can Smart Agreement Automatic Agreement? ? **

Smart Agreement Agreements, from simple financial vehicles to Badine transactions, from simple financial transport to simple financial transport. Here are the Somesme Ehamples:

1 * Suitable Chain Management: Manifacture can wise controlling through the movement of God’s goods in Multis, in a timely manner Aliifesar olifered.

2 * Real estadia: Landownners Smart Controcts Gassissip to prove by proving documentation by reading Needon Intermediators and Accounts.

3

Insurance : Insuration*Company Smart contracts processing, editing costs and ITMRove Cutorasor Cutorasor Cutorasor Satis.

Cryptourrenciy: SMART CONTRACT LIGHT NATIONALLY *

Smart contracts in 2014 were introduced in Vitalik Berinin, Canadian Cripurrennenty Battereur, which is part of the Etreum Platorm. Howest, it waved UncCenid 2016, that Tittal’s contracts began to be traction with a self -inventive attachment that did not prevent suitable applications. Then sit, cryptocincies like Eyeneum, and Litecoin has been calculated by a militated application.

Benefits of smart contracts **

The power of smart contracts eliminates Severel ofter including:

* EFICIFICCE EVICE*: Autesid Agreements reduce the need for intermediate, Increding EDFICIENCE and Cost Reducing.

* PARROVORD STOCURY : The data stored in the Smart contract, making it a moor to manette or delete.

* Reduced administrative administration burden: Smart Contracts Autoicks, which releases the time from Bisses and individuals to a higher vegetarian.

Challenes and restrictions

**

While smart contractors have a revolutionary revolutionary way of financing financial training, including a number of challenges and restrictions on Concairer:

Regulatory Insight : The Regulatory environment is evil, making it different in bisses on bsemnesees.

** Smart contracts must not compatible with eltling systems or infrastructures, Creatang Interodolality isheses.

SSCCARBIFIITY : Smart contracts can be slow and resources related to it by limiting their scale.

Conclusion

Smart contracts have a strong revolutionary way of financial training is emexed on “blockchain.