Unlock the secrets of the cryptocurrency markets: power flow power

In the world of cryptocurrency trade, market dynamics are fundamental for making informed decisions and achieving success. A key aspect that merchants often neglect is the flow of orders, which represents the address and intensity of the purchase and sale activities in a market. When analyzing the flow of orders, operators can obtain valuable information on the market sensation, identify possible commercial opportunities and make more effective investment decisions.

What is the flow of order?

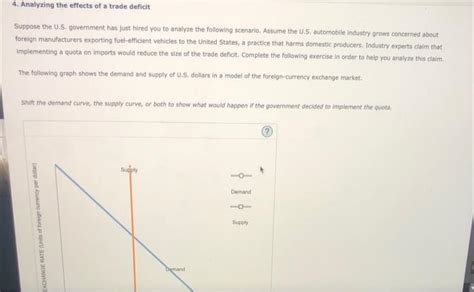

The flow of orders refers to the sequence of purchase and sale orders that enter or leave a market. It is essentially the movement of operations in different exchanges, corridors and platforms. In traditional markets such as actions, traders perform operations based on price movements, but in cryptocurrency markets, the flow of orders is more complex due to the decentralized nature of these activities.

The anatomy of the flow of the order

When analyzing the order flow, it is essential to understand that it is a dynamic process that can change quickly. The following components are essential to understand and interpret the flow of the order:

- Purchase orders : these represent potential buyers who are willing to purchase a particular cryptocurrency at a specific price.

- Sales orders : these represent possible suppliers who are willing to sell a cryptocurrency at a specific price.

- Filling rate : The percentage of orders performed successfully, indicating market efficiency.

- Liquidity : The amount of the negotiation volume between buyers and suppliers, which affects market prices.

Analysis of the order flow for better trade

To unlock the secrets of the cryptocurrency markets, operators must effectively analyze orders flow data. Here are some key strategies:

- Look for trends

: identify long -term trends in purchase and sale orders, as increases in the purchase volume for a specific period.

- Analyze the sensation : use indicators such as the relative force index (RSI) or the divergence of the convergence of the mobile media (Macd) to measure the feeling of the market and the possible purchasing/sale opportunities.

- Identify the flow flow models : search for models, such as peaks in the purchase volume during a specific period or decreases in the sales orders on the one hand of a market.

- Use graphic data : analyze graphic data to identify relationships between purchase and sale orders, price movements and other market indicators.

5

Tools to analyze the order flow

In the current it was digital, traders have access to a variety of tools to analyze orders:

- Cryptocurrency exchanges : Most main exchanges provide API data or allows users to download the flow of historical orders.

2

- Data suppliers : Companies such as CoinMarketCap, Cryptocompos and Etoro offer detailed data on the order flow for different cryptocurrencies.

Conclusion

The order flow is a critical aspect of the cryptocurrency markets that can provide valuable information on market dynamics. When analyzing orders, traders can obtain a better understanding of the market sensation, identify possible commercial opportunities and make more informed investment decisions. As the cryptocurrency space continues to evolve, the importance of the analysis of the flow of order will only increase.