Future of decentralized finance: Bitcoin (BTC) prospects and nonfungible chips (NFT)

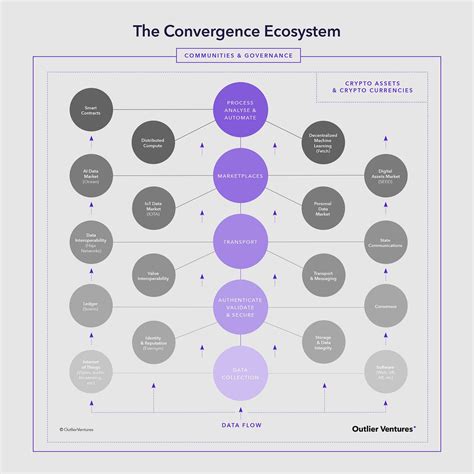

As the world continues to evolve at a rapid rate, the concept of decentralized finance (Defi) has gained significant attention in recent years. Defi refers to a new financial system built on blockchain technology, where smart and cryptocurrency contracts allow safe, transparent and decentralized transactions. Bitcoin, launched in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto, is often cited as one of the pioneering cryptocurrencies who have opened the way for Defi.

In this article, we will deepen in the world of Defi, exploring the role of cryptocurrency, especially Bitcoin (BTC) and non -functioning chips (NFT) in decentralized finance. We will examine the potential applications, risks and opportunities of these emerging technologies and what information they can provide since the successful launch of Bitcoin.

What is decentralized (Defi) finance?

Decentralized finances refer to a system in which financial transactions are facilitated by blockchain technology, without the need for intermediaries or central banks. This approach allows peer-to-peer transactions, reduces transaction costs and increases transparency. Defi platforms use intelligent contracts, which self -execute contracts with the conditions written directly in code lines, to automate the whole process.

Bitcoin (BTC): Pioneer

Bitcoin (BTC) has played a pivot role in outlining the concept of Defi. Introduced in 2009, Bitcoin is often considered the first decentralized cryptocurrency. Its creation was designed to provide a safe and transparent way for individuals to store and transfer the value without relying on intermediaries or central banks.

Being the largest and most used cryptocurrency, Bitcoin helped establish Defi as a viable alternative to traditional financial systems. The decentralized nature of Bitcoin has made it more resistant to censorship, regulation and handling of the market, offering an attractive option for investors who want a low risk exposure.

Unfungible tokens (NFT)

Unfungible tokens (NFT) are digital active that represent unique articles or collections. NFTs have gained significant attention in recent years, with the emergence of platforms such as Opensea and Rarible. These digital chips are stored on a blockchain, ensuring their deficit, their origin and property.

Perspectives from Bitcoin:

Successful launch of Bitcoin provides valuable information on potential applications and deficiencies. Some key take -ups include:

* Security : The decentralized nature of Bitcoin has made it extremely safe, without a single entity that controls the network.

* Regulation : The lack of central banks and the supervision of regulations has created an environment conducive to innovation and experience in Defi.

* Scalability : Bitcoin scalability problems have caused innovation in Defi solutions, such as scaling protocols such as Ethereum 2.0.

Perspectives from NFTS:

NFTS offers a unique opportunity for artists, creators and collectors to present their work through blockchain-based platforms. Some key take -ups include:

* Property : NFTs offer a safe and transparent way to represent the property of digital assets.

* Deficit : The deficit of NFTS has determined the demand, creating a market of great value for these unique collections.

* Artificial intelligence (AI) : NFT platforms with an AI base, allowing the creation of unique digital art pieces with automatic composition and optimization.

challenges and opportunities

While Defi provides significant opportunities, it also presents more challenges:

* Regulation : The lack of clear regulatory frames prevents the growth of Defi.