Understanding tokenomics in the world of Bitcoin (BTC): Deep diving

Tokenomics is more and more crucial for investors, developers and enthusiasts. To the concept of tokenomics, its meaning in the world of bitcoins and how it can help shape the future of cryptocurrency.

** What is tokenomics?

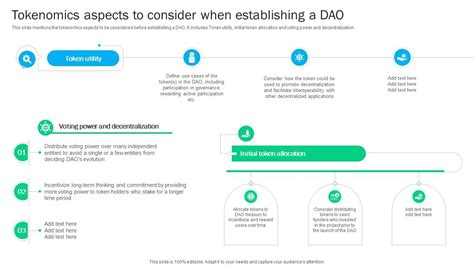

Tokenomics refers to economics and mechanics standing behind a specific cryptocurrency or token. It covers various aspects, including supply and demand, transactions, mining and government. Tokenomics helps programmers to create tokens that can be used for a wide range of goals,

The role of tokenomics in Bitcoin (BTC)

Bitcoin, a pioneering cryptocurrency, is at the forefront of tokenomics from the very beginning. The original creator of Bitcoin, Satoshi Nakamoto, designed a protocol for specific tokenomice. Here are some key aspects of tokenomics in Bitcoin:

- This limited supply forces owners to appreciate their coins more, affecting price fluctuations.

- Mining prizes

: encourages miners to secure and verify transactions, maintaining network stability.

- Economic load in various networks.

- Decentralized management : Bitcoin community is largely based on decentralized management (delegated autonomous control or DAC), such as the improvement of the witness (Segwit) and the introduction of lightning network. Future direction of the network.

. This balance helps to maintain and a healthy ecosystem in which new participants can join the network.

Impact of tokenomics on future changes

As Bitcoin evolutions, his tokenomics plays a significant role in shaping the future of cryptocurrency:

- Decentralized finances (DEFI) :

- Tokenomics will continue to affect the development of Stablecoin protocols and their integration with various financial applications.

3.

Application

Understanding tokenomics is crucial for anyone who is involved in cryptocurrency. Rules of supply and demand, mining prizes, transactions fees, decentralized tokens management and distribution, units can better appreciate complicated economics that shapes the world of Bitcoin and more.

As a cryptocurrency