How to develop a trading strategy based on market dynamics

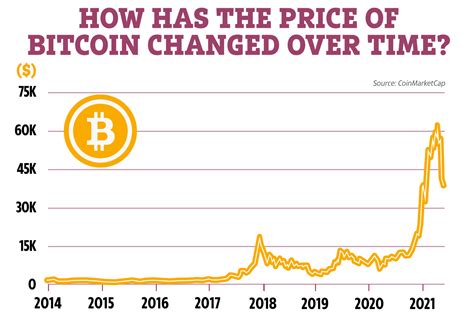

The world of cryptocurrency has undergone extraordinary growth and volatility in recent years. With the appearance of different cryptocurrencies, trading strategies have become more important for both professional traders and individual investors. The development of a trading strategy based on market dynamics is crucial for making knowledge and minimizing risk.

understanding of market dynamics

The dynamics of the market refer to the interactions and relationships between different assets, such as stocks, bonds or cryptocurrencies, on financial markets. In the context of cryptocurrency, the dynamics of the market involve understanding social, economic, policies and techniques that influence price movements.

Key factors that influence market dynamics

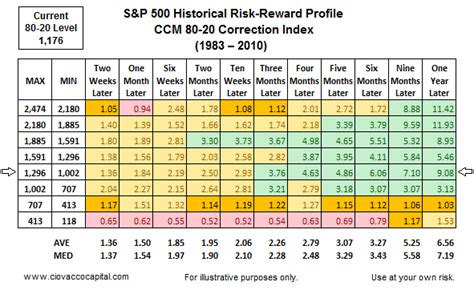

To develop a market dynamics -based trading strategy, it is essential to consider more key factors:

- Offer and request : The balance between buyers and sellers determines price movements.

- Sent of market : Positive or negative attitudes towards an asset can affect its price.

- Technical indicators : Diagram models, trends and other technical indicators provide information about the market dynamics.

- Fundamental analysis : Economic and social factors influence the value of an asset.

- Market volatility : Changes in market feeling and technical indicators can lead to significant price fluctuations.

Development of a trading strategy

To develop a trading strategy based on market dynamics, follow these steps:

- DO MARKET RESEARCH

: Gather market information, including news, events and economic data.

- Identify key indicators : Determine which technical and fundamental indicators are the most relevant to your asset.

- Set the trading rules : Define specific rules for introducing and exit transactions based on market dynamics.

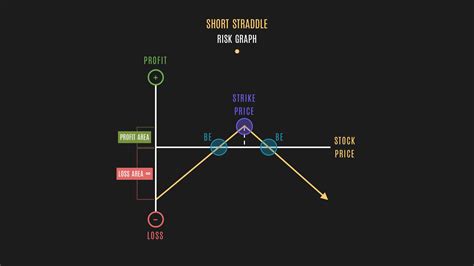

- Use diagram models : Identify the diagram models that indicate potential price movements, such as the tendency lines or support/resistance levels.

- Monitoring the market feeling : Follow the feelings through social networks, news stores and other sources.

Popular trading strategies based on market dynamics

Some folk trading strategies based on market dynamics include:

- The following trend : Identify the trends and trading in the direction of the trend.

- Drawing of the range

: Buy or sell in the priced intervals to capture small prices movements.

- Scalping : Execute more small transactions in a short period, taking advantage of the minor price fluctuations.

- Average reversion : bet on markets that tend to return to their average value after significant price movements.

Example of trading strategy

Here is an example of trading strategy based on market dynamics:

- Asset: Bitcoin

- Strategy: Trend following a moving crossover of 50 periods (MA).

- ** Input

- Exit rule : Sell when 50-me crosses below 200-Ma.

Conclusion

The development of a trading strategy based on the market dynamics is crucial for making informed decisions on cryptocurrency markets. Considering key factors, such as supply and demand, market feeling, technical indicators, fundamental analysis and market volatility, you can develop a profitable trading strategy that helps you browse the market ascents and downs.

Remember -va

- Always perform thorough research before entering any trade.

- Risk management is essential in cryptocurrency trading; Never risk more than you can afford to lose.

- Monitor and adapt -continuously the strategy as the market dynamics changes.