The Rise of Cryptocurrency and the Future of Non-Fungible tokens (NFTS): Understanding Their Impact on Ethereum (ETH)

In recent years, the world of cryptocurrency has undergone a significant transformation. The Emergence of Non-Fungible tokens (NFTS) has revolutionized the way we think about digital ownership and collectibles. But What Exactly Are NFTS, How Do they Work, And What’s Their Potential Impact on Ethereum? In this article, We’ll Delve Into the World of Cryptocurrency, Explore the Concept of NFTS, and Examine Their Future Prospects on the Ethereum Blockchain.

What are non-bungible tokens (NFTS)?

Non-Fungible tokens (NFTS) are unique digital assets that representation ownership of a specific item, Such as art, collectibles, or even in-game items. Unlike fungible tokens, which can be exchange for another identical asset, nfts are one-of-a-kind digital possessions that hold sentimental value or rarity. This concept is particularly relevant in the world of art, where ownership and provenance are paramount.

For Instance, A Rare Picasso Painting Might Have An NFT That Guarantees Its Authenticity and Scarcity. These Unique Tokens Allow Creators to Monetize Their Work in Ways That Traditional Art Market Systems Cannot.

The Rise of Ethereum (ETH) AS A Platform for NFTS

Ethereum is one of the most popular blockchain platforms in use Today, Known for its Scalability, Security, and Developer-Friendly Environment. The Launch of the ERC-721 Standard by Vitalik Buterin in 2017 Marked A Significant Milestone in the Development of NFTS on Ethereum.

ERC-721 Provides a Set of Rules and Tools That Enable Developers to Create, Manage, And Trade Digital Assets. This Standard Has Been adopted by over 1 Million Projects, Making It One of the Most Widely Used Standards for NFTS.

Impact of NFTS on Ethereum

The Integration of NFTS Into The Ethereum Ecosystem Has Opened Up New Possibilities for Creators, Collectors, and Buyers Alike. Some Potential Benefits Include:

Decentralized Marketplaces : NFT Marketplaces Like Rarable, OpenSea, and Superrare Have Democratized Access to Digital Art and Collectibles.

* Increased liquidity : the decentralized nature of nfts allows them to be traded more Easily than Traditional Assets on Centralized Exchanges.

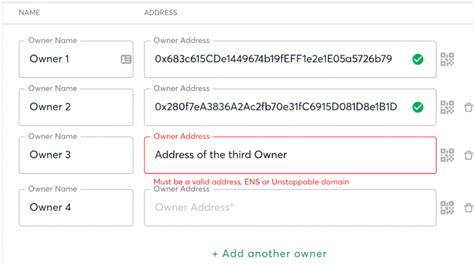

Improved ownership tracking : NFTS Provide a Transparent Record of Ownership, Making It Easier for Buyers and Sellers to Verify the Authenticity of An Asset.

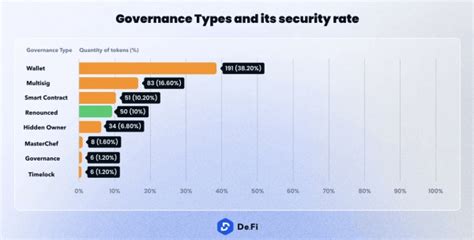

However, The Emergence of NFTS also Raises Conerns About Potential Market Volatility, Regulatory Uncertainty, and Environmental Impact. As the NFT Space Continues to Evolve, It’s Essential to Address These Challenges and Establish Clear Guidelines for NFT Creators, Traders, and Holders Alike.

The Future of Non-Fungible tokens (NFTS) on Ethereum

As Cryptocurrency and Blockchain Technology Continue to Advance, We Can Expect Significant Developments in the World of NFTS. Some Potential Trends and Opportunities Include:

* Improved Scalability : The Integration of Sharding Solutions Like Optimism or Polygon Will Increase Ethereum’s Capacity for Handling A Higher Number of Transactions per second.

* Enhanced Security Features

: Blockchain Analytics Tools and AI-Powered Solutions Will Help Identify and Mitigate Potential Threats to NFT Marketplaces.

* Increased adoption : As More Creators, Collectors, and Buyers Explore the World of NFTS, We Can Expect to See Increased Demand for Ethereum-Based Platforms.

Conclusion

The Rise of Cryptocurrency and NFTS HAS Transformed the way we think about digital ownership, collectibles, and ownership Verification. Ethereum’s Role As A Platform for NFTS is Undeniable, Providing A Secure, Scalable, And Developer-Friendly Environment for Creators to Build and Sell Unique Digital Assets.