Understanding the Concept of Air Drops in Cryptocurrency

Airdrops is an exciting concept in the cryptocurrency world where new users or investors can be introduced to a specific project or marker at any initial cost. But what exactly is the source and how does it work? Their benevolies.

What is the moment of air?

Airdrop is an advertising event in which young users or investors are invited to join a particular cryptocurrency project or marker. This can be done. AirDrop aims to create buzz and contract new members to the project.

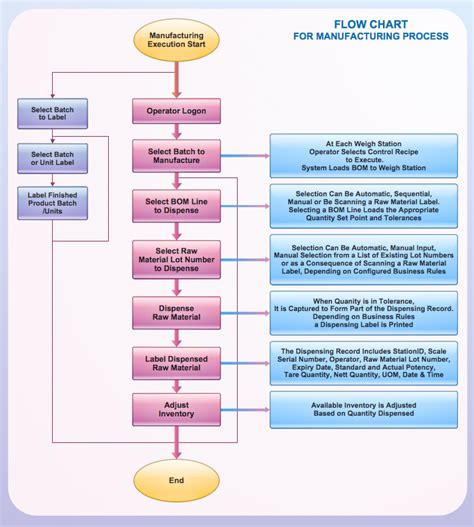

How does airdrops work?

AirDrope Usually Follows and Similar Process:

1

Project Statement : A New Cryptocurrency Project Announces its intention to Manage Airdrop.

- Token distribution :

.

- AirDrop Period : During this time, chips holders are invited to participate and receive tokens as a reward.

AirDrops Benefits

AirDrops Offers and Number of Benefits:

.

2.

3

Risks Associated with AirDrops

While airdropes can be exciting and rewarding, there are also some remarks to consider:

*

2

Token Diluting : High -scale Air Spread Can Lead to Excessive Marker Marker Saturation, causing prices to fall or become less attractive to investors.

3

Strategies for Participation in Airdops

Follow these tips to maximize your ability to participate in airdops:

- Explore the project : before joining any airmaker, study the project’s white paper, team and community to understand their values and values.

- Join Social Media Groups : Contact Other members on social media platforms or online forums related to the project.

*

- Monitor Marker Prices : Keep up with market fluctuations and be prepared for Price Drop.

Conclusion

Airdrops offers a unique opportunity for new cryptocurrency users and investors to participate in a project without previous costs. ALTHING THAT ARE BENEFITS TO Participation, It is important to understand the risks associated with these events. By doing your research,