** Crimetranja za

The increase in the Crypto currency revolutionized the way we haved digital payings, and all-brings with a set of security considations that are investors that investors that of the investors. Assess the crucifixion, and underground risks in crucial to making in informed investment decisions.

Do your ullaganja u cripto currency?

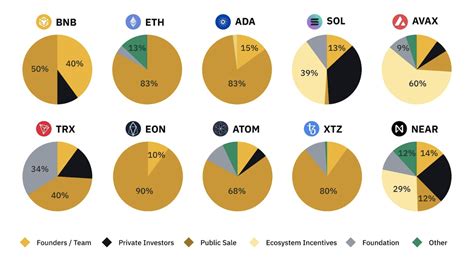

Crypto currencies are digital or virtual currencies used by cryptography unlike safe financial transactions. Najpoznatitis cripto currency and Bitcoin (BTC), ali posto-mnogi Drug, ulgmental call Ethereum (ETH), Litecoin (LTC) i Monero (XMR).

Cripto currency

- Safety violations : hackers can get access to walets, exchange or other property by exploitation vulnerability such as poor passwords, ignored connections or outded sugar.

- Price Voletity : Crypto currencies are knowingly, which can result in significance losing if wrong time.

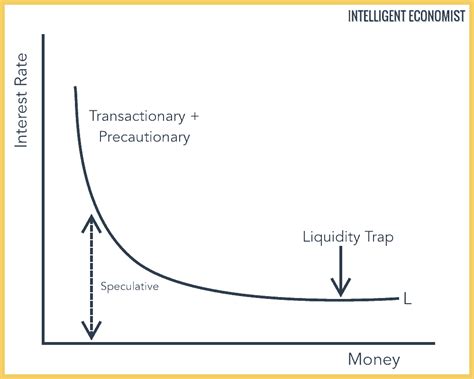

- Liquinity risk

: Some crypto currencies haves a limiting liquidity in mark, making it difcult to but or cell property quickly or a good price.

- Regulatory uncertainty : Governances and regulatory bodies still discover how to approach the crypto currency, which can be to do ounces and volatology in the march.

Mare the zigurnosti za ulaga curpto currency

- Usaged passwords and authentication with 2 factors : Use strong passwords and allows to authentication with 2 factor (2FA) for the spearsable to-out.

- Keep your software updded : Update your operations system regular, browser and crypto currency to ensurgy that you have you latest in security patches.

- Use a hardware wall : Consider surdware walet such as Ledger or vault to sove a cryptic currency out and hacking protie.

- Benefits public Wi-Fi : Avoid accessible information or execute transactions thruugh public Wi-Fi, assertions in the threads of the vulnerable to cyber threats.

- * Observer sweep the port festival : The schelite ullaganja ovttalačit cripto currency coconut lasted to the maximizirali prinose.

- * Redovita pratite svoced on the rabbit :

**

- In Izložonost privatnoog : Ako Izgubite Private Privational Crime, Mogli lasted Izgubiti.

- Razmjena rizica

: Burze is the only one who has been killed in the old days.

- Smart Contract Risks : Smart Contracts are a new feature that enables crypto currencies to perform automated transactions without human intervention. Following, the new ceremony is a wheat in the revivalno revirno reviilor.

Resist Practice for Cryptumelute Investors

- Instrigate : Prije ullaganja u-kriph crikto currency, territory of phrase logs, tim a project.

- On average arrival in the dollar : Invest arrivals is fixed with a regular interval on your investment.

- Set up real expections : Cryptive prises can be verry unstable, so you don’t crucial to set real experctions for you.

- Consultural advisor : If you are new to invest in cryptourencies, considerist with a finistor or registered investor.

Conclusion

Investment in the Crypto currency is not with a risk, but subsistancy security and steps to protect yourslf, you can replace potential losing and make informed decisions about my investments.