Cryptocurrency Trade Psychology: How to Browse In Right Market and Increase Returns with Cardano (Ada)

In recent years, cryptocurrencies have gained tremendous popularity as Bitcoin and other Altcoins have experienced prices rapidly. But what encourages these sudden changes? In this article, we will go into the world of cryptocurrency trading psychology and investigate how it influences investments such as Cardano (Ada).

Understanding of cryptocurrency trading psychology

The cryptocurrency market is known for its high volatility, which makes each trade a gambling. This unpredictability can cause significant loss if they are not properly controlled. In order to successfully trade cryptocurrency, you need to be aware of the psychological factors that promote market behavior.

1

- This can cause impulsive purchases and selling, which can cause major losses.

- Information overload : The amount of cryptocurrency news, rumors and speculations alone can be huge, which makes it difficult for investors to remain informed and make rational decisions.

Effect on Cardano (ADA) investment

Cardano (Ada) is a decentralized, open source blockchain project aimed at ensuring a safer, more transparent and sustainable alternative to traditional cryptocurrencies. As with any property, it is necessary to understand the market and its main factors to invest in Ada.

- Market mood : The overall Cardano (Ada) approach can greatly impact its price. If investors’ confidence is high, prices usually rise. Conversely, if the moods are negative, prices may be reduced.

2.

- Acceptance and adoption percentage : Cardano (Ada) adoption percentage can also affect its price. If more institutional investors and main consumers begin to accept assets, prices may increase.

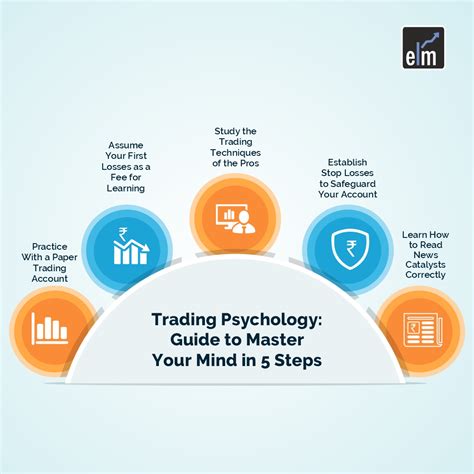

Cryptocurrency trading strategies

To navigate the volatile cryptocurrency market and increase your return using Cardano (Ada), consider the following strategies:

1

2.

- Market Time : Avoid impulsive decisions to make short -term market fluctuations. Instead, focus on long -term growth and diversity strategies.

- Risk Management : Set clear risk management parameters to make sure you are not too leverage or under -capitalized.

Cardano (Ada) Investing: Tactical Attitude

To successfully invest in Cardano (Ada), consider the following tactical approach:

1

- Technical Analysis

: Use technical indicators to determine possible purchase or sales signals in the property trading range.

- Risk Management : Set real expectations and risk limits for each trade or position.

Conclusion

Cryptocurrency Trade Psychology can be a double -edged sword when it is about Cardano (Ada) investment. By understanding the factors that promote the market behavior, adopting effective strategies and managing your emotions, you can confidently browse the volatile cryptocurrency market.

Remember that investing in any property causes a characteristic risk, including market fluctuations and changes in regulation.