“The crypto market focuses on the BSV and the costs explained”

The cryptography market has been in a state of flow in recent times, with many investors looking at Bitcoin SV (BSV) as a potential alternative to his larger brother, Bitcoin (BTC). But what distinguishes BSV from the rest of the market? And how do the costs are on the equation?

What is Bitcoin SV (BSV)?

Bitcoin SV (BSV) is a blockchain network of proof of open source proof which was launched in 2018. Unlike its predecessor, Bitcoin Cash (BCH), which used a traditional mining consensus algorithm, BSV has adopted proof of ‘Assistance (POS) protocol, making it more energy efficient and environmentally friendly.

Why investors are interested in BSV

So why do investors think BSV deserves to be considered? One of the main reasons is that it has the potential to be a more lasting alternative to Bitcoin. With a lower energy consumption profile, BSV could use investors looking for a more environmentally friendly cryptocurrency. In addition, the consensus algorithm of proof of implementation of BSV makes it more resistant to centralization and censorship, which could make it an attractive option for those looking for a decentralized currency.

How the costs work on the cryptography market

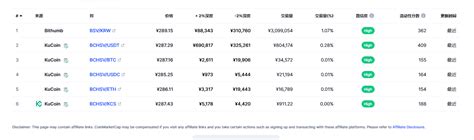

Fees are a crucial aspect of the cryptography market, and they can have a significant impact on the feeling of investors. In general, the costs refer to the costs associated with transactions on the blockchain network. On a given block, BSV generally spends 6 to 8% of its total transaction value as costs. However, this number can fluctuate depending on the specific use case and the congestion of the network.

For example, if you send 1 BTC (the same currency that exists in Bitcoin cash) to another user, your transaction costs could vary from 0.000001BTC (or approximately $ 5 per transfer) for low -traffic transactions at around 200 $ per transfer for high- volume transactions.

Stop orders and their impact on BSV

A stop order is a type of market order that asks merchants to sell an asset at a specific or better price. Regarding Bitcoin SV, stop orders can play an important role in determining the active price movement. While the value of BSV fluctuates, investors will use stop orders to lock the profits and limit losses.

For example, if you buy 1 BTC (the same currency that exists in Bitcoin) at a price of $ 50,000, you can set a stop order to sell it to $ 55,000 or better. This would mean that you are locking your profit if the price increases above $ 55,000. Conversely, if the price drops below $ 48,000, you can define a new stop order for sale at this lower price.

In conclusion

Although costs are an essential aspect of the cryptography market, they should not be the only objective when it comes to investing in Bitcoin SV (BSV). However, understanding the functioning of the costs and what impact they have on the feeling of investors is crucial to make informed investment decisions. While the BSV continues to develop and mature, investors will have to remain vigilant and adapt to changing market conditions.

In this article, we have explored the world of cryptographic markets and highlighted the factors that influence price movements. By remaining informed of the costs and their impact on arrest orders, investors can make more informed decisions when it comes to investing in the BSV or any other cryptocurrency.