The Bear Market Survival: Necessary Trading Techniques to help you drive Krypto storm

As the global cryptocurrency market continues to vary wildly, many investors leave me wondering how to navigate in these fraudulent waters. As prices collapse and volatility soaring, it is easy to feel drowning and insecure about how to cope with the bear market. However, with the help of the right strategies and technologies, you can minimize losses, maintain your capital and even inevitable recession.

Understanding the bear market

Before the necessary trading techniques from our dod, it is necessary to understand what the bear market is. The bear market is a long -term period when the cost of cryptocurrency or other digital property is below its historical average indicating a reduction in investors’ feelings and trust. During this phase, investors usually sell their property at a loss, which can lead to significant losses for those who hold them.

Trade techniques necessary for the bear market

So how can you cope with the bear market? Here are some essential trade techniques that have proven to be effective in navigating the same market:

: A long -term perspective is essential for navigating the bear market. By focusing on a larger image, you can drive shorter -term prices and make more conscious investment decisions based on market basics.

Bear Market Additional Strategies

In addition to these essential techniques, there are some extra strategies that have proven to be effective in navigating in the bear market:

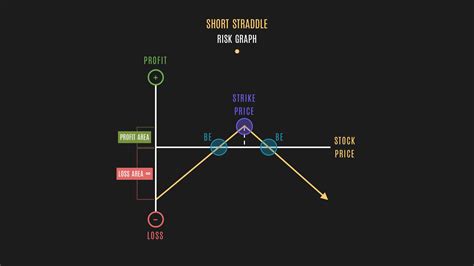

: The protection includes the use of derivatives or other financial instruments to alleviate possible losses during the bear market.

2 Use the lever effect rationally and only when needed.