The Struggle is Real: Updating Ethereum on A Slow Computer

As a cryptocurrency enthusiast, you’re probably no stranger to the frustration of dealing with outdated blockchain technology. With Bitcoin, Ethereum, and Other Popular Cryptocurrencies Being Constantly updated to Improve Security, Scalability, And Performance, It’s Easy To Get Left Behind If Your Computer or Internet Connection Isn’t Up To Speed.

In this article, We’ll Explore Why updating Ethereum can be a challenge on Slow computers and provide tips and tricks to help you keep your blockchain running smoothly.

Why is updating Ethereum so hard?

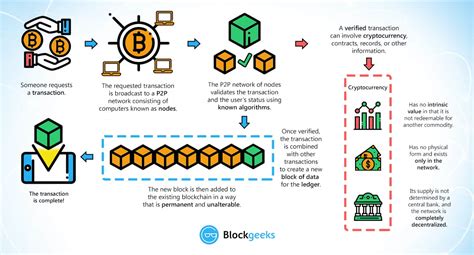

Ethereum, like other major cryptocurrencies, relies on the underlying proof-of-work (POW) or proof-of-stake (POS) consensus algorithms used by its network. These Algorithms Require Significant Computational Power to Validate Transactions and Update The Blockchain. On a Slow computer with limited resources, it can be difficult to keep up with the demands of the network.

The Impact on Internet Connection Speed

Adding an Extra Layer of Complexity Comes from the Need for Frequent updates, which are your internet connections to be stable and fast. Just a moderate increase in upload speeds can lead to significant slowdowns if your download speeds are significant slower than your upload speeds.

The Struggle is Real: Symptoms of Slow Ethereum Updating

If you’re experientate slow computer or internet connection issues that make it difficult to keep up with the latest ethereum updates, you may notice the following symptoms:

- Your Computer’s Temperature Increases As It Runs Background Processes

- Your Network Connection Becomes Sluggish and Slow to Establish Connections

- Updates Take Longer Than Expected, Even Faster Internet Plans

- You Start to Receive Errors or Warnings About Outdated Software or Libraries

Best way to update an outdated ethereum blockchain

Fortunately, there are some effective ways to update your ethereum blockchain without sacrification too much speed:

1.

Update The Bitcoin Client (But Only When Necessary)

While It May Seem Counterintuitive to use a Different Cryptocurrency Client, Updating the Bitcoin Client Can Help Improve Overall Performance by Reducing Unnecessary Updates and Bandwidth Usage.

For Example, you Might Consider Updating from Version 0.19.0 to the latest 1.24.X, Even if you’re not activy using bitcoin. This update will also be applied to your ethereum client, so it won a significant impact on your overall ethereum performance.

2.

Use a Caching Solution

There are Several Caching Solutions Available for Ethereum that can help reduce the overhead of downloading and updating the blockchain:

Ethereum Wallet’s Built-in Cache : Some versions of Ethereum Wallets, Like the desktop client or mobile app, have a caching feature that stores frequently-used data locally.

Third-Party Caching Tools

: Tools Like etcD, Docker, or Simple SCRIPTS Can Be Used to Cache Ethereum-Related Data in Your Local Machine.

3.

Optimize your computer’s hardware

While There’s Limited you can do to significant IMPROVE THE PERFORMANCE OF YOUR SLOW COMPUTER, OPTIMIZING ITS HARDWARE CAN Help:

* Disable Unnecessary Processes : Close Any Background Processes That Are Not Essential for Cryptocurrency Work.

upgrade your ram and cpu : Ensure your computer has sufficient ram (at least 16 gb) and a capable CPU (Intel Core i5 or amd equivalent).

Use a Faster Internet Connection Plan : If Possible, Upgrade to a Faster Internet Service Provider.

4.

Consider Upgrading to a More Powerful Machine

If you have the budget, Consider Upgrading Your Computer’s Hardware To Improve Its Performance. A fast processor and more ram can make a significant differentence in your ethereum update speed.