The Role of Machine Learning in Creating Unique NFTS

Non-Fungible tokens (NFTS) have revolutionized the world of art, collectibles, and digital ownership. These Unique Digital Assets Are Created Using Various Techniques, Including Machine Learning Algorithms That Can Generate Original Artwork, Music, OR Even Entire Universes. In this article, We’ll Delve Into the Role of Machine Learning in Creating Unique NFTS and Explore Its Potential Applications.

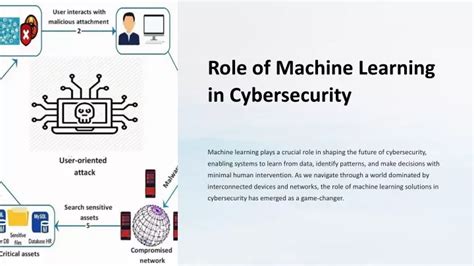

What is Machine Learning?

Machine Learning (ML) refers to a Subset of Artificial Intelligence (AI) That Enables Machines to Learn From Data Without Being Explicitly Programed. This technology uses algorithms to analyze patterns, identify relationships, and make predictions or decisions based on the data. In the context of nft creation, machine learning can be used to generate unique art pieces, music tracks, or even entire worlds.

How Machine Learning Creates Unique NFTS

Machine Learning Algorithms Can Create Unique NFTS Through Various Techniques, Including:

- Generative Adversarial Networks (goose) : whole consist of two neural networks that interact with each other to generate new data samples. In the context of nft creation, a generator network produces images or videos, while a discriminator Network Evaluates and Corrects these outputs.

- Recurrent Neural Networks (RNNS)

: RNNS Are designed to process sequential data, Such as text or audio. They can be used to generate unique musical compositions or art pieces that exhibit complex patterns and structures.

- Transfer Learning : Transfer Learning Allows Machine Learning Algorithms to Leverage Pre-Trained Models and Fine-Tune them on Specific Tasks, Enabling the Creation of New NFTS With Unique Styles.

Applications of Machine Learning in Creating Unique NFTS

Machine Learning Has Numerous Applications in Creating Unique NFTS:

- Art Generation : Artists can use machine learning algorithms to generate new artwork, reducing the need for manual creation.

- Music Composition : Musicians can rely on goose and rnns to produce original music compositions or remixes.

- Virtual World Creation : Virtual Worlds and Games Can Be Created Using Machine Learning Algorithms That Generate Unique Environment and Assets.

- Collectibles : NFT Platforms Can Use Machine Learning to Create Unique Collectible Items, Such As Rare Digital Art Pieces.

Benefits of Machine Learning in Creating Unique NFTS

The Benefits of Machine Learning in Creating Unique NFTS Are:

- Increased efficiency : Machine Learning Automates The Creation Process, Reducing the Time and Effort Required to Produce High-Quality NFTS.

- Improved consistency : Machine Learning Algorithms Can Generate Consistent Results Across Different Ierations, Ensuring A Higher Level of Quality Control.

- New Creative Possibilities : Machine Learning Enables Artists and Musicians to Explore New Creative Avenues and Push the Boundaries of What is Possible.

Challenges and Limitations

While Machine Learning Offers Numerous Benefits, There are also Challenges and Limitations:

- Data Quality : The Quality of Data Used for Training Goose and Rnns Can Affect the Generated Results.

- Regulation : The use of machine learning in NFT Creation Raises Regulatory Questions, Such as ownership and copyright issues.

- Ethical Concerns : The Potential Misuse of Machine Learning Algorithms Raises Conerns About Bias, Fairness, And Transparency.

Conclusion

Machine Learning HAS Revolutionized the World of Art and Collectibles, Enabling the Creation of Unique NFTS That Are Both Visually Striking and Intellectual Stimulating. While there are challenges and limitations to this technology, its potential applications in Creating New and Innovative NFTS is fixed.