OKX to Organize Public Sales For A Revolutionary Cryptocurrency Project

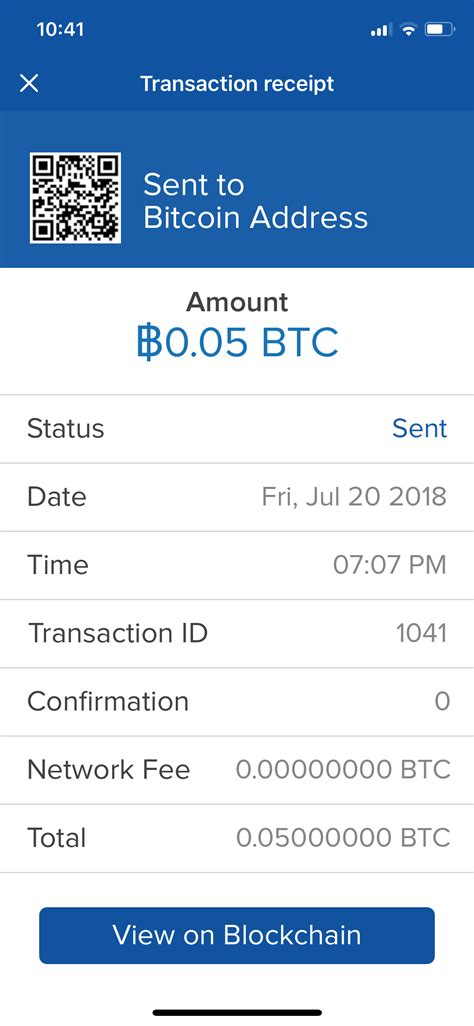

Market, OKX, One of the World’s Leading Digital Assets Platforms, is to hold a public sale for its highly anticipated new marker. The development of the development of blockchain technology and promises to introduce a new era of decentralized trade.

Project:

OKX works tirelessly behind Project, which is still hidden in secrety, is proud of the unique algorithm of consensus that uses the evidence (POS) and multi -stage purses to provide transactions.

Public Sale:

, OKX will hold open public sales, allowing potential investly from the platform. Cryptocurrency enthusiasts and investors who want to enter the potentially on the ground floor of the game changing project.

Public sales, The OKX platform will provide invisible integration with different stock exchanges, allowing buyers to easily transfer their own funs and market markers on other platforms.

Why is it Important:

Cryptocurrency Market, as it would show the value Invital Institutional Investors.

Token Details:

The new marker, which has been developed over the past year, is proud of a unique set of features and benefits. Token’s Native Cryptocurrency Called “Oct” will be used

Security and Transparency:

Okx is committed to ensure that its public sales meet the highest standards of security and transparency. The platform has introduced a robust against money laundering (Multi) and your customer (KYC) protocols to protect buyers from the potential risks related to cryptocurrency trade.

In addition, okx will provide details on all the marker details Traders is committed to create a strong and sustainable ecosystem.

Conclusion:

Okx’s new marker public sales promises to be a highly welcome event in the cryptocurrency market. Technology and traditional market principles in this project, all the game is changed. The Digital Asset World.

Disclaimer:

This article is only for informational purposes and should not be considered as an investment advice. Any information provided