Here is an article on a cryptographic-specific trading strategy using ERC-20 chips, focusing on Biteti:

“ERC-20 Bitget Trading Strategy: A profitable approach to cryptographic transactions”

As the cryptocurrency market continues to develop, traders are looking for efficient and cost -effective strategies to capitalize in price movement. A popular approach is leverage trading, in which traders use busy funds to increase their potential income. In this article, we will study the trading strategy with Bitget lever ERC-20, and we will give you step by step on how to implement it.

What is ERC-20?

The ERC-20 (Token Standard Ethereum) is the first and most used marker in the Ethereum blockchain ecosystem. It was created by Joseph Sabella and was opened in 2017 with a total offer of 100 million chips. The ERC-20 has become a popular choice for a variety of use, including decentralized finances (DEFIs), games and social platforms.

ERC-20 Bithet Trade Strategy ** Bitget

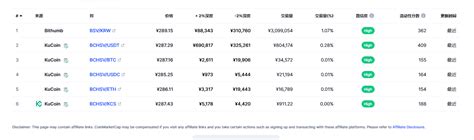

Bitget is an exchange of Japanese cryptocurrencies that offer leverage deals in several assets including EUR/USD, USD/Brl and many more. Their trading strategy with ERC-20 lever uses the fact that most ERC-20 chips are traded in decentralized stock exchanges (Dex), such as Bitget.

The strategy is related to Bitget funds loan to sell large positions to take advantage of the price movement, at least reducing the risk. Here is a simplified division of activities involved:

- Create an account : Sign up for Bitget and Fiat’s currency store or cryptocurrency.

- Select an active pair : Select EUR/USD Active Pair to sell leverage positions.

3

Set the lever

: Choose the desired lever level (eg 10x, 20x) using BitetGet lever.

4

Create a trading position : Place trade in selected assets using borrowed funds from Bitget.

- Supervise and adjust : Be careful in the market and adjust the position as needed to maintain profitability.

Benefits ERC-20 Pre-Trade Strategy

This strategy has more advantages:

* Risk Management : Risk restriction with lever, merchants can protect their capital and reduce potential losses.

* Profitability : Merchants can enhance their income through borrowed funds that make it more likely to achieve cost effective results.

* Diversification : This strategy allows traders to diversify their portfolios while selling several active couples.

Risks associated with ERC-20 trading strategy with lever

As long as the strategy offers more benefits, the risks must be taken into account:

* Leading boundaries : Traders can exceed the lever borders and can withstand significant losses.

* Market volatility : Price movements in fixed assets or other transactions can affect the performance of the position taken.

* Taxes and Commissions : Traders will transfer taxes and commissions on the use of Bitet services.

Conclusion

The ERC-20 leverage trading strategy offers a profitable approach to cryptocritic trade, especially on platforms such as Bitget. Using borrowed funds to increase income while reducing the risk, traders can make significant profits in the cryptocurrency market. However, it is important to understand the risks and caution related to this strategy in detail when implementing it.

Disclaimer : This article is only for informational purposes and should not be considered as an investment in tips. Cryptocurrency trade involves high risks, including losing all investments. Always do your research before making trade decisions and consult a financial consultant.