Benefits and Risks of Using Mixers in Your Crypto Strategy

As the cryptocurrency market continues to grow and evolve, many investors are exploring new tools and strategies to optimize their portfolios. One popular tool that is gaining more and more attention is the mixer, a service that combines multiple cryptocurrencies into a single asset in exchange for a transaction fee. But before you venture into the world of cryptocurrencies, it’s important to understand the benefits and risks associated with this strategy.

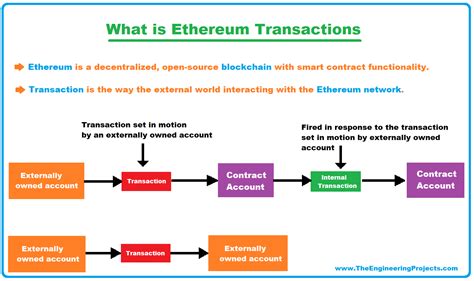

What is a mixer?

A cryptocurrency mixer is an online platform that takes individual cryptocurrencies, breaks them into smaller pieces (called “coins” or “tokens”), and then mixes them together. The mixed coins are then sold on the open market, often at a price significantly lower than their original value. This process aims to eliminate the need for individuals to use their own private wallets, reducing the risk of theft and volatility associated with traditional cryptocurrency storage.

Benefits of Mixing Cryptocurrencies

- Reduced Storage Costs: Mixing your cryptocurrencies can save you on transaction fees and storage costs. Traditional wallet services charge high fees per transaction, while mixers reduce these costs by splitting multiple coins into smaller portions.

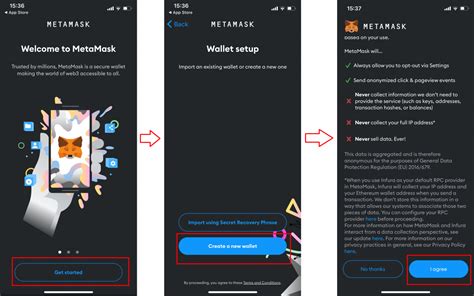

- Increased Security: Mixers provide an additional layer of security for your assets. Since the mixer does not have direct access to your private keys, hackers are less likely to access your funds.

- Diversification: Mixing cryptocurrencies allows you to diversify your portfolio by adding new assets without directly investing in them.

- Accessibility: Mixers often offer a user-friendly interface and educational resources to help users understand the process.

Risks of Using Mixers

- Lack of Transparency: Some mixers are known to be opaque about their processes, transactions, and ownership structures. This lack of transparency can lead to investor distrust.

- Regulatory Risks: Regulation of cryptocurrency mixers varies across the world and some may be subject to anti-money laundering (AML) or know-your-customer (KYC) requirements, which could impact their operations.

- Tax Complexity: Mixing cryptocurrencies involves multiple transactions and assets, making tax compliance more complex for investors.

- Market Volatility: Prices of mixed coins can fluctuate significantly, which can lead to losses if you are not aware of market dynamics.

- Lack of Control

: Once your funds are mixed, it is difficult to track or access their movements.

Best Practices for Using Mixers

- Choose a Reputable Mixer: Do your research and choose a mixer with a good reputation, transparent processes, and robust security measures.

- Understand the Fees: Be aware of all the fees associated with using the mixer, including transaction fees and storage fees (if applicable).

- Diversify Your Portfolio: Don’t rely too much on a single asset; maintain a diversified portfolio to minimize risk.

- Monitor Market Fluctuations

: Keep an eye on market trends and adjust your strategy accordingly.

Bottom Line

Mixers can be a useful tool for investors looking to reduce storage costs, diversify their portfolios, or increase security. However, it is important to weigh the pros and cons and exercise caution when using this service. Understanding the potential benefits and drawbacks will help you make informed decisions about whether cryptocurrency mixing is right for your investment strategy.

Recommendations

- Do your research and choose a reputable mixer with a good reputation and transparent processes.

- Learn about the fees associated with using the mixer.

- Diversify your portfolio to minimize risk.

- Monitor market fluctuations and adjust your strategy accordingly.