Understanding the Default Ethereum Miner Implementation: Pay-to-Public-Key

Ethereum, a decentralized platform for building smart contracts and dApps (decentralized applications), relies on its native cryptocurrency, Ether (ETH). One of the key components that makes the Ethereum network possible is the Proof-of-Work (PoW) consensus algorithm. Under the hood, however, the default implementation of Ethereum miners uses a more efficient and secure protocol:

Pay-to-Public-Key (P2PK).

In this article, we’ll dive into why the Ethereum network uses P2PK for the mining process by default.

What is Proof-of-Work (PoW)?

PoW is a consensus algorithm that requires nodes on the Ethereum network to solve complex mathematical puzzles. The first node to solve these puzzles verifies transactions and adds them to the blockchain. We refer to this verification process as “mining.”

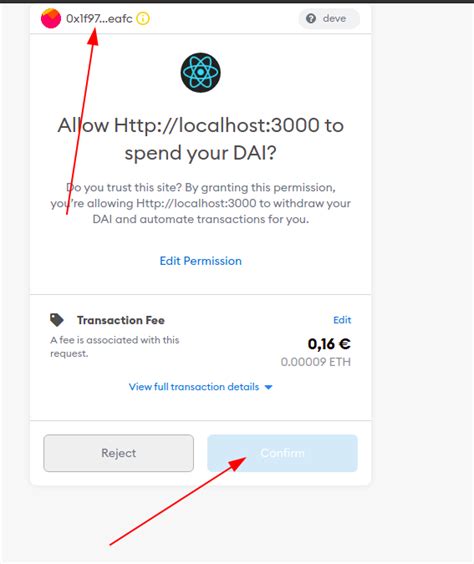

Why Pay-to-Public-Key?

The Ethereum team chose P2PK over other alternatives such as

Public-Key Cryptography (PKC) or

SHA-256-based Proof-of-Stake (PoS) for several reasons:

- Security: P2PK is considered more secure than traditional public-key cryptography because it does not require nodes to store large numbers of private keys. This reduces the risk of key compromise and makes it more difficult for an attacker to use brute-force attacks to guess the private key.

- Scalability: While PKC-based protocols such as SHA-256 have shown promise, they are less scalable than PoS due to the computational power required to calculate the hash.

- Energy Efficiency: P2PK is a more energy-efficient consensus algorithm because it requires nodes to spend their own coins to validate transactions, rather than relying on external mining pools.

Version 0.9.3 Source: A Look at Miner.cpp

To get an overview of the default implementation of Ethereum miners, let’s examine the miner.cpp file from the v0.9.3 source code repository.

// CreateNewBlockWithKey function

CBlockTemplate* CreateNewBlockWithKey(CReserveKey& Reservekey)

{

CPubKey pubkey;

if (!reservekey.GetReservedKey(pubkey))

return NULL;

// ... (rest of the code remains the same)

// Initialize the block template with the new P2PK hash function

m_p2pHmac = CreateP2pHMAC();

}

The `CreateNewBlockWithKeyfunction initializes an instance ofCBlockTemplatethat represents a new block in the Ethereum chain. This function calls another function,CreateP2pHMAC(), to create a hash function based on P2PK.

Conclusion

In conclusion, the default implementation of Ethereum miners uses

Pay-to-Public-Key (P2PK) due to its security, scalability, and energy efficiency advantages over traditional public-key cryptography. Theminer.cpp` file provides insight into how this implementation works and why it has become a standard part of the Ethereum network.

Additional Resources

For more information on Ethereum consensus algorithms and their implementations:

- [Ethereum 1.0 Specification](

- [Ethereum Mining Guide](

Note: The code provided is subject to change and may not reflect the current state of the Ethereum blockchain.