Ethereum: Running a Bitcoin CPU Miner from the Command Line on Ubuntu for Slush’s Pool

As a beginner in the world of cryptocurrency mining, it is important to understand how to set up and run a Bitcoin CPU miner from the command line on your Ubuntu system. In this article, we will walk you through the process of installing and configuring Ethereum for Slush’s pool.

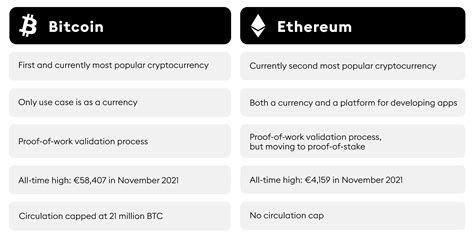

Why Ethereum?

Ethereum is an alternative blockchain platform that allows miners to validate transactions and create new blocks without having to use the underlying Bitcoin network. By running the Ethereum mining rig on your Ubuntu system, you can mine Ethereum using a command line approach. This setup provides a more efficient way of processing transactions than traditional Bitcoin mining methods.

Hardware Requirements

To run a command line miner on Ubuntu, you will need:

- Compatible CPU (Intel Core i5 or AMD equivalent)

- Sufficient RAM (at least 8GB)

- Reliable internet connection

- Bitcoin wallet software and Slush pool account

Software Installation

- Update your package list: Run the following command to make sure you have the latest packages installed:

“Exactly.”

Sudo apt update

“

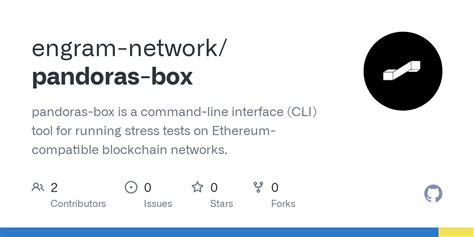

- Install required software: You will need to install the following packages:

- “git” to interact with Ethereum blockchain data

- “build-essential” to compile and run the miner

- “git-bash” for the bash shell on your Ubuntu system

- Install Slush’s pool software: Download the latest version of the Download Slush pool software from the official website:

“Exactly.”

wget

“

Unzip the archive and run the following command to install the software:

“Exactly.”

tar -xvf ethpool-software-1.9.2.tar.gz && cd ethpool-software-1.9.2 && ./configure && make

“

Configure the Slush pool

- Create a new user for your miner: Run the following command to create a new user with permissions to run the miner:

“Exactly.”

sudo adduser miner

“

- Set up your Ethereum wallet: Connect your Bitcoin wallet to your Ubuntu system.

- Configure Slush Pool Settings

:

In the root directory of your Ubuntu system, create a file called “pool.conf” with the following content:

“Exactly.”

[Ethpool]

User = miner

Password =

“

Replace “

Configure Miner

- Edit the miners.json file: Create a new file named miners.json in the same directory as the pool.conf file:

“Exactly.”

[ethminer]

Number of processors = 1

Min weight = 10

“

- Add your Ethereum wallet to the miner: Run the following command to add your Ethereum wallet to the miner configuration:

“Exactly.”

./miner –addwallet=

“

Replace “

Start Miner

- Start Miner: Run the following command to start the miner in the background:

“Exactly.”

sudo ./miner &

“

Monitor and optimize performance

You can use tools like “mpstat” or “htop” to monitor your miner’s performance. You may also want to adjust “numCPUs”, “minDifficulty” and other configuration settings based on your system’s hardware capabilities.

To summarize, running the Command Line Ethereum CPU Miner on Ubuntu for the Slush pool provides a flexible and efficient way to mine Ethereum without breaking the bank. By following these steps, you can set up a reliable and scalable mining operation that meets your needs. Happy mining!