Tips for Making Large Cryptocurrency Withdrawals Safely

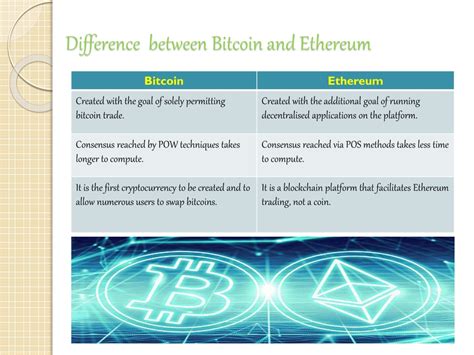

The rise of cryptocurrency has opened up new avenues for financial transactions, giving users more freedom and flexibility in managing their digital assets. However, with the growing popularity of cryptocurrency, there is also an increased need to ensure that large withdrawals are made safely and efficiently. In this article, we will explore some essential tips for making large cryptocurrency withdrawals safely.

Choose a Trusted Exchange

The first step to ensuring a safe withdrawal process is to select a trustworthy exchange or platform that offers great withdrawal options. Some popular exchanges include Coinbase, Binance, Kraken, and Bitstamp. When choosing an exchange, look for the following:

- Security Ratings: Check whether the exchange has received a high rating from security experts, such as those from cryptocurrency security research firm, AIC.

- User Reviews

: Read reviews from other users to gauge the exchange’s reliability and customer service.

- Fees and Charges: Understand the fees and charges associated with the withdrawal process, including fees for withdrawing large amounts.

Verify Your Identity

Large withdrawals require verification of your identity, which is essential to prevent illicit activity. To verify your identity, you will need to provide:

- Proof of Address: A document or secure wallet that proves you own the cryptocurrency.

- Identification Documents: A valid government-issued ID, such as a driver’s license or passport.

Use Secure Payment Methods

To minimize risk during large withdrawal processes, use secure payment methods, such as:

- Secure Wallets: Use a trusted and secure wallet supported by an established exchange.

- Two-Factor Authentication: Enable two-factor authentication to add an extra layer of security.

- Regular Updates: Make sure your software and wallet are updated regularly to stay protected from potential vulnerabilities.

Keep Your Private Keys Safe

Private keys are the key to accessing your cryptocurrency, so it’s essential to keep them safe from unauthorized access. To prevent loss or theft:

- Store Private Keys Safely: Keep your private keys encrypted and secure on a hardware device, such as a physical wallet or USB drive.

- Use a Secure Password Manager: Consider using a reliable password manager to protect sensitive information.

Monitor Your Account Activity

Regularly monitor your account activity to detect any suspicious behavior that may indicate unauthorized access. To do this:

- Set up transaction alerts: Enable transaction alerts on your exchange or wallet to be notified of any large withdrawals.

- Regularly check your account balance: Regularly monitor your account balance to ensure it matches the expected amount.

By following these tips, you can significantly reduce the risks associated with making large cryptocurrency withdrawals safely. Always prioritize security and take steps to protect yourself from potential threats.