Here is an article that explains the meaning of the error code “-26” in the context of Bitcoin:

Interpreting Error Code -26: A Guide to Bitcoin Transactions

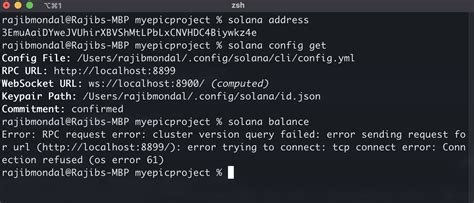

When it comes to Bitcoin, transactions are processed by a network of computers called nodes. These nodes check and validate the transaction data, ensuring that the sender has the necessary funds and that the recipient is willing to accept the transfer. One common error in this process occurs when the transaction is sent to a node on the blockchain, including the “sendrawtransaction” RPC (Remote Procedure Call) method.

In your case, you are seeing an error with the code -26 when broadcasting a transaction on the testnet ( Let’s see what this error message means:

What does -26 mean?

The error code -26 usually means that the node is not in the “final” state. In Bitcoin, nodes are considered final when they have received all the necessary data from other nodes and can complete the transaction verification process.

How does the sendrawtransaction method work?

When you use the sendrawtransaction RPC method to broadcast a transaction on the testnet, it sends the transaction data over the network. However, if the node is not in the final state (i.e., it is still receiving or processing other transactions), the error -26 occurs.

What does this error mean?

The sendrawtransaction RPC method returns an error (-26) if the node is not in the final state because the transaction data has not yet been verified and verified by all nodes on the network. This can happen for various reasons, such as:

- Insufficient funds: If you have not received enough funds from other nodes to cover the transaction fees.

- Missing or incomplete information

: If the transaction contains missing or incomplete fields, such as signature verification, or if it does not comply with the testnet rules and regulations.

- Network congestion or overload: If the network is experiencing high levels of activity, causing the node to become congested or overloaded.

What can you do?

To resolve this error, you need to make sure that the transaction data is fully authenticated and verified by all nodes on the testnet. Here are some steps you can take:

- Check your funds: Make sure that you have enough funds to cover the transaction fees.

- Fill in the missing fields: Make sure that the transaction data includes all the required fields, such as signature verification.

- Follow the testnet rules and regulations: Learn the testnet rules and regulations to avoid problems during transactions.

By following these steps, you will be able to resolve the -26 error and successfully broadcast the transaction on the testnet. If you are still having problems or have additional questions, please feel free to contact us!

![Ethereum: Best place to buy bitcoins? [duplicate]](https://makolli.tj/wp-content/uploads/2025/02/b83a08a3.png)