Increase in cryptocurrency: Guide to market trend analysis for better trading

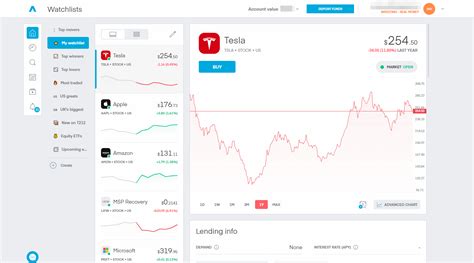

The cryptocurrency has been holding in recent years, and the total market value is more than $ 2 trillion. Demand for professional merchants and investors is growing. However, in a complex world of cryptocurrency, navigation can be scary, especially when it comes to analyzing market trends.

Trends and techniques will help you make information in the world of cryptocurrency.

Why analyze market trends?

Analyzing market trends is essential for every trader or investor who wants to succeed. . Here are only a few reasons why analyzing market trends is crucial:

*

* Risk Management

: Analyzing Market Trends will help you set realistic expectations of price fluctuations,

* Scalable : Trend analysis gives you a trade in smaller capital by adding your potential products.

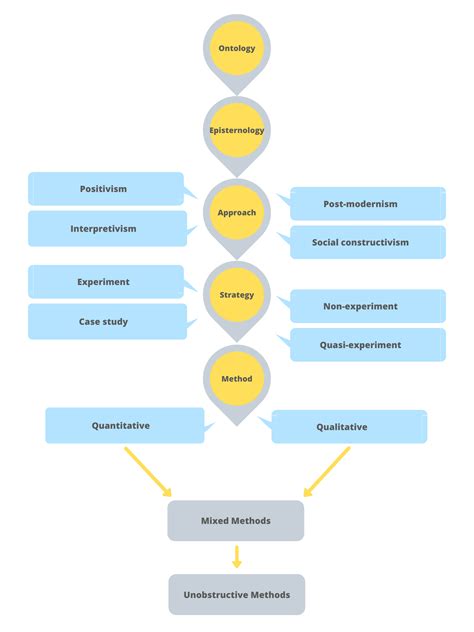

Tools and techniques to analyze market trends

To analyze the trends of the cryptocurrency market, you need access to many tools and techniques. Here are some of the most effective methods:

- By applying a variety of technical indicators, such as moving averages, relative strength index (RSI) and bollinger lanes, you can get insights in the market direction.

- This includes the study of information on supply and demand, infe section and regulatory policy.

. Alongside

- These algorithms are used in particular to detect abnormalities and identify potential trading opportunities.

Best Practices to analyze market trends

You can use your analysis in the best possible way of the following best practices:

- Stay disciplined : Avoid emotional decision -making by staying disciplined with your approach.

2.

3.

- Continuously train yourself : Stay up -to -date with the latest market trends, news and analyzes by regularly reviewing relevant publications and participating in conferences.

conclusion

Cryptocurrency, technical skills requirement, basic knowledge and analytical thinking. Best practices and keep up to date with market development, you can make more detailed

.