How to create a profitable trading strategy relative strength index (RSI)

The world of cryptocurrency trade has experienced significant growth in recent years and, consequently, the need for effective trading strategies. One of the popular tools that can help merchants can make a well -founded decision, the Relative Strength Index (RSI), a technical indicator developed by J. Welder Wilder Jr.

In this article, we use RSI to create a profitable trading strategy that covers its basics, benefits and proven practices for implementation.

What is a relative strength index (RSI)?

RSI is a momentum indicator that measures the amount of recent price changes to determine over -purchased or excessive conditions. This is calculated that the ratio of shares differences is distributed over a period of average price change in the same period. The resulting value ranges from 0 to 100, higher values indicate more extreme price movements.

How does RSI work?

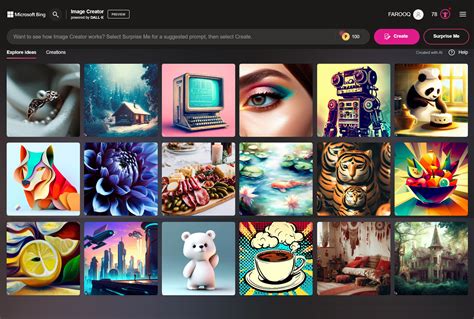

Here is an example of the RSI indicator:

RSI Trading Strategy

The creation of a profitable trading strategy with RSI includes the use of this indicator to identify potential purchase and sell opportunities. Here is a step -by -step guide:

: Set a candle holder with two indicators: RSI and the other indicator you choose (such as MACD or Bollinger bands). RSI should also be depicted on the same diagram.

RSI Trading Strategies

Here are some popular trading strategies that include RSI’s index:

: Use Bollinger bands to produce purchase and sales signals based on 80 years of age or younger.

Advantages of using RSI

Conclusion

The creation of a profitable trading strategy with RSI requires how this indicator works and incorporates it into the general trading plan. By complying with the steps outlined above and combining other technical analysis tools, you can develop a reliable trading strategy to help you make well -founded decisions in the world of cryptocurrency trade.