the importance of risk management in trading litecoin (LTC): a guide to minimizing losses

In the Ever-Evolving World of Digital Currencies, Trading Cryptocurrencies Like Litecoin (LTC) can be a thrilling experience for traders. However, with Great Rewards Come Great Risks. Without proper risk management strategies, even seasoned traders can quickly find themselves on the losing side. In this article, we’ll delve into the importance of risk management in Trading LTC and provide actionable tips to help you minimize losses.

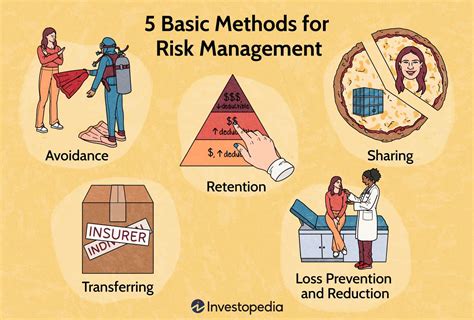

What is risk management?

Risk Management Refers to the process of identifying potential threats or downsides associated with a trade, asset, or investment. It involves understanding your goals, risk tolerance, and market conditions before making a decision. Effective Risk Management Allows Traders to Weigh Their Options Carefully, Set Realistic Expectations, and Adjust their strategies accordingly.

Why is Risk Management Crucial in Litecoin (LTC) Trading?

Litecoin, like other cryptocurrencies, is a highly volatile asset with significant price fluctuations. The value of LTC can drop rapidly due to various factors such as:

To mitigate these risks, traders must prioritize Risk Management in their LTC Trading Strategy. Here are some key considerations:

: Invest a fixed amount of capital at regular intervals, regardless of market conditions, to reduce timing risks.

Actionable tips for minimizing losses in litecoin (LTC) Trading

To maximize your chances of success and minimize losses, consider the following tips:

: Develop a structured approach to risk assessment and management using tools like technical indicators or trading systems.

Conclusion

Trading Litecoin (LTC) Carries inherent Risks, but by implementing effective risk management strategies, you can minimize losses and increase your chances of success. Remember that risk management is a continuous process that requires ongoing evaluation and adjustment. By following the tips outlined in this article, you’ll be well on your way to navigating the world of cryptocurrency trading with confidence.

Remember: