Understanding the risks of isolated margins in cryptomena

Cryptomena have gained considerable popularity over the years, and many investors have been trying to use their potential growth. However, one aspects of trading in cryptomes that may be particularly dangerous is isolated margins. In this article, we immerse ourselves into the risks associated with isolated margins and explain why it is essential for investors to understand these risks before we engage in trading in cryptomes.

What is an isolated margin trading?

Isolated margin trading applies to the type of margin trading, where the trader maintains his own funds separately from the funds used for trading. This means that any losses that have arisen during the commercial meeting shall be borne by the merchant while their other assets are not affected. In the isolated margin account, the merchant has two separate accounts:

1

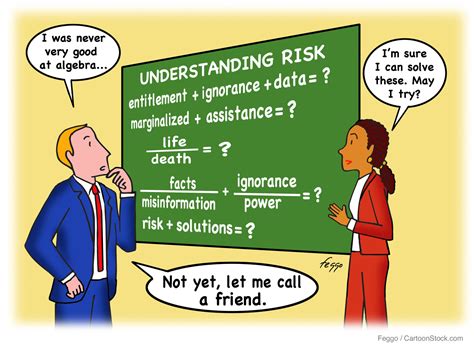

Risks associated with isolated margin trading

Isolated marginal trading poses significant risks including:

1.

: If an isolated margin account is used for trading, the trader may get a margin call if their primary margin account drops below a certain threshold. This can result in further losses for the merchant and potentially force them to close positions that they cannot afford to lose.

: If a trader uses a third -party intermediary or a third -party exchange, which is not transparent in connection with the risk management procedures, this may lead to unexpected fees, fees or other fines.

Consequences of Ignoring Risks

Ignoring the risks associated with isolated margins can have serious consequences for investors:

1.

2.

Relieving risks

In order to alleviate these risks, it is essential that investors understand their own risk tolerance and effectively manage their trades. Here are a few steps that can help you:

1.

Conclusion

Isolated margin trading may be a high -risk activity for investors who do not understand their own risk tolerance and lack effective risk management strategies. By recognizing the risks of isolated margins and steps to mitigate them, traders can minimize potential losses and ensure long -term financial success in the cryptocurrency markets.