Use of commercial indicators for algondandand (something) investment: guide

Algorand, a decentralized public network operating system, has attracted significant attention to the cryptography market because of its innovative algorithm and consensus infrastructure. If you are considering investing in Algorand or want to improve your negotiating strategy with indicators, this article will provide an overview of how to use commercial indicators in something.

What are the commercial indicators?

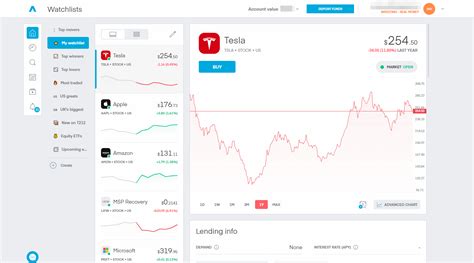

Commercial indicators are the mathematical tools that operators use to analyze the price of prices, identifying possible purchases or sales signals and prediction of future market behavior. These indicators can be based on several time periods, such as in the short term (1 minute) or in the long run (daily), and often include basic and technical data, such as analysis of offer and demand.

Why use commercial indicators in something?

Negotiating indicators offer several benefits when applied to investment in Algorand:

Selection of commercial indicators for Algorand

To create a profitable strategy with Algoranda indicators, select one alignment with their investment and risk tolerance goals:

Commercial Strategy Indicative in Algoranda

Here’s an example of how you can include commercial indicators in your strategy:

Best Practice to use commercial indicators in Algorand

To maximize the effectiveness of commercial indicators in something:

: Try your strategy based on indicators of historical market data and continuously purify it depending on your experience.

Conclusion

Commercial indicators can be a valuable tool for Algor and investors who want to improve their market analysis and strategy development skills. Combining these tools with basic data and adjusting them to changing market conditions, traders can create more effective commercial strategies that generate significant yields.