Title: Exploring the Possibilities of Ethereum as a Generalized Distributed Ledger: Can All Inputs Become Transaction Fees?

Introduction

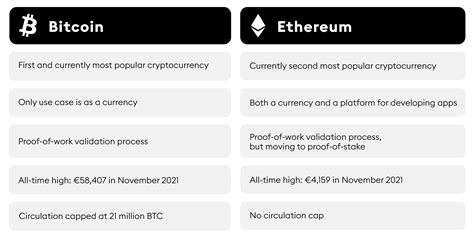

In recent years, the Bitcoin (BTC) and Ethereum (ETH) networks have attracted considerable attention from developers, entrepreneurs, and researchers seeking to use alternative cryptocurrencies as a generalized distributed ledger. While these blockchain platforms have evolved into robust systems with their own set of use cases, one intriguing aspect has been overlooked: Can all inputs to the Bitcoin or Ethereum network become transaction fees?

Background

In traditional Bitcoin, transactions are recorded using a Proof-of-Work (PoW) consensus algorithm, which incentivizes miners to validate and broadcast transactions to the network. To secure the network, miners must expend significant computing power in the form of “gas” (a unit of cryptocurrency that represents the amount of computational resources required). This gas-based system led to the development of smart contracts on the Ethereum blockchain.

The Ethereum Smart Contract Environment

The Ethereum platform, with its emphasis on programmability and scalability, has enabled the creation of a wide range of decentralized applications (dApps) that leverage smart contracts. These contracts allow users to define rules to execute specific actions in response to certain events or data inputs. In essence, smart contracts can be thought of as a generalized distributed ledger, where all inputs are considered transaction data.

Can all inputs become transaction fees?

In theory, yes. According to the Ethereum Virtual Machine (EVM) specifications, any input that is not explicitly specified as an output in a contract becomes a transaction fee. This means that if a smart contract defines an event or function call without a corresponding output, all the computational resources required to execute that function will be considered a payment for execution.

Practical Implications

While this concept may seem appealing at first glance, several practical implications become apparent:

: Adding transaction fees as an input would require significant changes to the EVM and smart contracts, which may not be possible without substantial updates to the underlying Ethereum codebase.

Conclusion

While it is interesting to explore the possibility of using Bitcoin or other altcoins as a generalized distributed ledger, it is essential to recognize the potential drawbacks. The scalability limitations of the current Ethereum network and the complexity of smart contracts make implementing such a system difficult. However, for developers who still want to use alternative cryptocurrencies as a generalized ledger, understanding this concept can provide valuable insights into the possibilities and challenges ahead.

As the lines between blockchain platforms continue to blur, it is essential to consider the potential tradeoffs and implications of each technology when evaluating its suitability for various use cases.