AI Ethics in Cryptocurrency Trading: Balancing Innovation and Responsibility

In recent years, artificial intelligence (AI) has transformed many industries, including finance. One of the most exciting areas of AI application is cryptocurrency trading. With its enormous potential to automate investment decisions, high-frequency trading, and risk management, AI has become a key tool for investors looking to maximize profits.

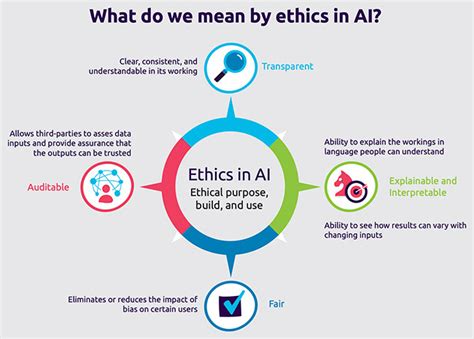

However, as AI has become increasingly important in cryptocurrency markets, important questions have arisen regarding ethics and responsible innovation. In this article, we will examine the key issues related to AI in cryptocurrency trading, analyze the potential benefits and drawbacks of the technology, and outline best practices for developers, regulators, and investors.

Benefits of AI in Cryptocurrency Trading

AI has played a key role in streamlining various aspects of cryptocurrency trading. Here are a few examples:

Concerns about AI in cryptocurrency trading

While AI has the potential to revolutionize cryptocurrency trading, there are several issues that need to be addressed:

: The regulatory landscape surrounding AI in finance is still evolving. Governments and regulators are struggling to establish clear guidelines for the use of AI in cryptocurrency markets.

Best practices for responsible AI development

To mitigate the risks associated with AI in cryptocurrency trading, developers should follow the following best practices:

Regulatory framework for AI in cryptocurrency trading

To facilitate responsible AI development, governments and regulators are creating frameworks for the use of AI in cryptocurrency markets. Here are some of the key takeaways from the framework:

: Anti-corruption laws will help prevent corruption and ensure transparency in AI-based decision-making.

3.