Cryptocurrency Double Sword: Unpacking Risk and Options

The cryptocurrency market has experienced a meteorical increase in recent years, with prices However, below this seemingly unstoppable surface surface is a complex risk that could eventually undermine the basics of the industry. This article will delve into the concept of Systemic Risk, with the Mood of the Cryptocurrency Market and the possibility consequences of investors.

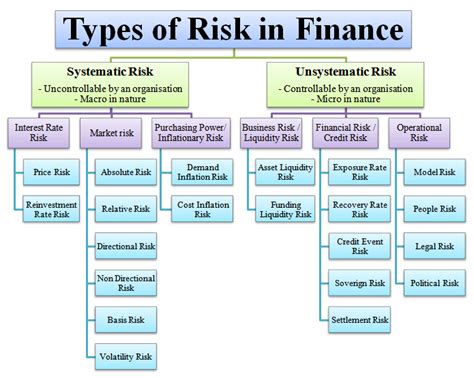

What is a Systemic Risk?

Systemic Risk Risk Risk Risk Risk Risks to the Characteristic Dangers that financial Systems in General May Fail or Collapse If the Individual Components are several damaged. System will be disrupted or destroyed, causing widespread instability and potentially causing global economic collapse. .

In the context of cryptocurrency, the systematic risk acquires a new and especially in terms of form. Bitcoin (BTC) and Ethereum (ETH) means that there are no central authorities or financial institutions that are active – making them more vulnerable to collapse.

Connection Between Systemic Risk and Cryptocurrency Market Mood

Market Mood is the emotional state of investors, which is influenced by factors such as news, social media and market psychology. When it comes to cryptocurrency, the market mood in recent years has been a wildly fluctuating between euphoria and despair.

The market mood was mostly optimistic, with many investors believing that the rally is sustainable and that the value of cryptocurrencies will continue to increase. However, as prices beg

The time of this. Market, with many investors, with many investors now consider cryptocurrencies to be a high -Mk, high -pay game that may have a heavy fall in prices.

POSSIBLE CONSEQUENCES OF INVESTORS

So There are only a few possible consequences here:

* Loss of confidence :

* Market volatility

: This can make investments.

Increased Regulatory Test : Given Current Concerns about Systematic Risks, Government and Regulators are increasingly taking care of the industry –

Conclusion

Cryptocurrency has shown considerable resistance in recent years, it is important for investors to be cautious about the market. Systemic Risks are typical of the industry and the market mood can change at any time, causing several consequences.

Careful Research, Diversify Participation and to be informed about market development.