Ethereum: is the ram or the computing power more important for the hashrate?

When it comes to ethereum, the hashrate referers to the total number of calculations performed per second by the Network’s Miners. While Both Ram (Random Access Memory) and Computing Power Play Crucial Roles in determining the hashrate, research suggests that computing power is currently more important.

why is computing power more important?

- Hashrate calculation

: The hashrate calculation involves multiplying the total number of available cores by the number of threads per core. Since RAM is used to store data and instructions for each Thread, it’s less efficient than using Processing Power. In contrast, computing power directly contributes to the overall hash rate.

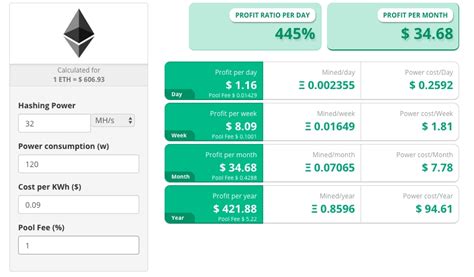

- Energy Consumption : Computing Power Requires Significant Amounts of Energy, which can lead to High Electricity Costs and Environmental Concerns. In turn, this increased energy consumption may result in lower hashrates per unit of energy consumed.

- Resource utilization : With Limited Hardware Resources available, optimizing the use of these resources is crucial. Miners need to balance their computing power with ram usage to ensure optimal performance.

Is Ram Still Important?

While Ram is essential for historing data and instructions, Impact on hashrate is relatively negligible compared to computing power. However, have a sufficient copper can help mitigate some issues related to high-energy consumption, such as:

- Power-Saving : Having More Ram Can Enable Miners to Reduce their overall energy usage, leading to lower costs.

- Optimization : With more memory available, miners can optimize their algorithms and software to achieve better performance while minimizing power consumption.

how do I allocate resources?

To Maximize hashrate on your Ethereum Network:

- Choose a Suitable Mining Hardware : Select a motherboard with sufficient copper (at least 16 GB) and a high-performance GPU.

- Optimize GPU USAGE : use the latest GPU drivers, and ensure that all necessary components are properly configured for optimal performance.

- Balance Resource Usage

: Monitor your Energy Consumption and Adjust Your Allocation of Resources accordingly.

In Conclusion, While Ram is still important for historing data and instructions, computing power remains more critical in determining ethereum’s hashrate. By optimizing your Mining Hardware and Balancing Resource Usage, you can help achievement better performance and lower costs on the network.