In the complex world of cryptocurrency, navigation: a guide for encryption researcher, portfolio diversification and exchange

The world of cryptocurrency has passed far since its inception in 2009. Bitcoin’s original hype is today altcoins and blockchain-based property, the space is constantly evolving. One important part of navigating this complex landscape is the right tools for diversifying your portfolio and risk management. In this article, we are studying three key components: Crypto Explorers, portfolio diversification strategy, and exchange that meets these needs.

Crypto Explorers: Cryptocurrency Research Spine

Crypto Explorer is a tool that allows users to find, analyze and visualize a large number of blockchain funds. These researchers often contain qualities such as:

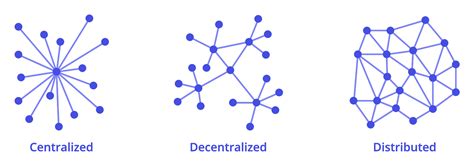

* Blockchain Mapping

: Detailed Presentations using the underlying Blockchain architecture, which allows users to identify potential vulnerabilities and optimize their investment.

* Intelligent Contract Analysis : Examination of smart contracts that are self-implemented programs that automate certain events or processes on the Blockchain network.

* Market Information : Real -time market information, allowing users to remain up -to -date with prices, trading quantities and other relevant indicators.

Popular crypto studies include:

- [CoinmarketCap] (

- [Blockfi Explorer] (

- [Cryptoslate] (

Portfolio Diversification Strategies: Risk Balancing and Reward

Diversification of a portfolio is an important part of risk management in cryptocurrency mode. By distributing investments in multiple asset classes, users can reduce their dependence on one investment and mitigate potential losses.

Here are some portfolio diversification strategies that must be taken into account:

* Allocation of assets : Sharing part of your portfolio into different asset classes such as equities, bonds or encryption currencies.

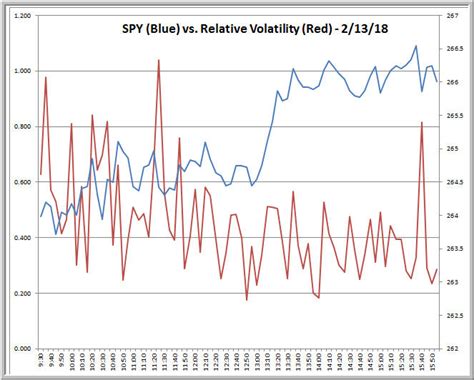

* Average dollar point : Placing a fixed amount at regular intervals, regardless of market conditions, to reduce the effect of volatility.

* Protection : Using derivatives or other strategies to replace potential losses in one asset class in another.

Some popular portfolio diversification tools are:

- [Investopedia portfolio diversification tool] (

- [CoinmarketCapin Crypto Portfolio Divegence tool] ( -portfolio-divergence-tool)

- [Cryptoslate’s Cryptocurrency Portfolio Diversification Calculator] (

Exchange: Base for buying cryptocurrencies, for sale and trade

The exchange is a digital platform that allows users to buy, sell and exchange cryptocurrencies. Changes provide an efficient and safe way to get into the cryptocurrency market.

Here are some of the key features of the exchange:

* Order Types : Users can place different types of orders such as market orders, border orders, stop loss orders and more.

* Safety : The regrets typically provide solid security measures to protect and prevent hacking.

* Liquidity : Exchanges often have a high level of liquidity, which makes it easier to buy and sell users at low prices.

Popular shifts include:

- [Coinbase] (

- [Binance] (

- [Kraken] (

In summary, navigation in the complex world of encryption requires a combination of tools, strategies and knowledge. By utilizing a cryptic researcher, portfolio diversification strategies and exchange users can effectively manage the risk and maximize potential returns in this rapidly developing state.

![Metamask: is there a way to pre sign tx with metamask? [duplicate]](https://makolli.tj/wp-content/uploads/2025/02/697282fb.png)